Confused by cryptocurrency? Our beginner’s guide is here to help

Investing in cryptocurrency is all the rage.

But what does crypto even mean? How does it work? And what should you consider before investing in the digital market?

We’ve rounded up answers to some common crypto questions to help you make sense of this digital money.

- What is cryptocurrency?

- What are the most popular cryptocurrencies?

- Is crypto insured or backed by anything?

- Why is cryptocurrency so volatile?

- Is crypto a good investment?

- Is Dupaco a crypto exchange?

- What should you consider before investing in crypto?

What is cryptocurrency?

Cryptocurrency (also called crypto) is digital money people use for investments and purchases. You exchange physical currency to buy “coins” or “tokens” of a type of cryptocurrency.

Most people still regard crypto as an investment in the future. It’s even become an accepted asset class, with investment managers creating portfolios that include crypto strategies.

But some retailers also accept crypto coins as payment. You complete transactions online or with a debit card like BitPay.

Cryptocurrency is unique because it’s decentralized and not regulated by any government or institution. Instead, every cryptocurrency transaction is verified through virtual ledgers called blockchains, a database of complex, unique codes.

Crypto is stored in a digital wallet. You access this wallet through a “key,” which is another unique code and serves as proof of ownership.

What are the most popular cryptocurrencies?

Nearly 20,000 cryptocurrencies are traded publicly, according to market researcher CoinMarketCap.com.

You’ve likely never heard of most of them. But here are some of the top contenders:

- Bitcoin: Bitcoin is the most well-known cryptocurrency. It was created in 2009 by an anonymous person who goes by the code name Satoshi Nakamoto. It’s “mineable.” Groups of computers seek opportunities to process crypto transactions on a blockchain ledger. Those computer users receive small amounts of cryptocurrency in exchange for processing and hosting the blockchain detail.

- Ethereum: This popular cryptocurrency is also “mineable.” And miners get paid in Ether coins.

- Dogecoin: The crypto started as a joke in 2013. But it has since made many headlines, thanks to its gains and frequent tweets by Tesla CEO Elon Musk.

Is crypto insured or backed by anything?

Cryptocurrency isn’t insured or backed by a standard like U.S. currency is. Instead, crypto users regulate it via the internet.

By comparison, deposits at Dupaco are federally insured up to $250,000 by the National Credit Union Administration, a U.S. government agency. (Members of federally insured credit unions haven’t lost one penny of insured deposits in the entire history of credit unions!)

Why is cryptocurrency so volatile?

Cryptocurrency’s decentralization makes it highly volatile.

Since there’s no regulation, demand and supply can drive the price of a cryptocurrency through the roof or plummet to the ground—practically overnight.

“Like any investment, there can be favorable gains but also losses, including principle in a non-insured product,” said Dupaco Chief Risk Officer Todd Link.

Here’s how that volatility can play out:

- Bitcoin increased by 610% from May 2020 to May 2021. So, a $1,000 investment held for just one year would be worth $7,100 if sold in early May 2021.

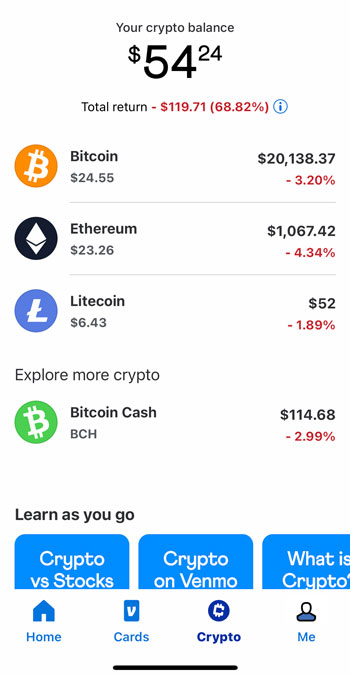

- But it can also lose value. To experiment with crypto, Dupaco Chief Marketing Officer Dave Klavitter bought a small amount of Bitcoin, Etherum and Litecoin through the Venmo app in December 2021. Since then, his investment has lost 68.82% of its value.

With its large swings in value and lack of regulation, crypto isn’t for the faint of heart. Instead, it’s aimed at those with a high tolerance for risk and a longer investment horizon.

Is crypto a good investment?

The short answer: It depends.

Investing in crypto is trending. But that doesn’t mean it’s right for everyone.

Cryptocurrency is widely acknowledged as being highly speculative. Investor Warren Buffet has said he’ll never invest in it due to the volatility.

But there’s also a lot of interest in investing in this space. If you’re among them, Dupaco’s Mark Hoaglin has some advice:

“It’s not an ‘either/or’ but an ‘and,’” said Hoaglin, senior vice president, Wealth Management & Insurance Services. “If you’re interested in investing in cryptocurrency, it should be part of a broad investment strategy that considers your risk tolerance, investment time horizon and goals.”

So, a small percentage of your total investments going toward crypto might provide your portfolio with additional diversification.

Is Dupaco a crypto exchange?

Dupaco is not a crypto exchange. And you can’t purchase crypto through Dupaco.

“As a credit union, we seek to meet the needs of our member-owners and protect their deposits under federal NCUA insurance,” Link said. “With the growing speed of electronic payments, there are many safe and effective ways to move money without the volatility associated with cryptocurrency.”

But you can invest in crypto through a separately managed account offered through Dupaco Financial Services. DFS provides access to an investment fund that holds various cryptocurrencies in the portfolio.

DFS financial advisors can help you determine the most suitable investments based on your investment objectives.

Request a free consultation with DFS >

What’s next for crypto at Dupaco? Link said the financial cooperative continues to monitor the entire payment ecosystem for opportunities, including crypto.

The Federal Reserve is even experimenting with digital currency.

“That product will take time to build out. But the benefits would be significant for transaction-based use,” Link said.

Benefits would include:

- Stability of the currency (backed by the federal government)

- Tied to the value of the U.S. dollar

- Widespread global acceptance

“If it comes to fruition, the Federal Reserve product would benefit transactors but would not be a popular choice for speculative investors,” Link said.

What should you consider before investing in crypto?

Before investing in any of the thousands of cryptocurrencies, consider these factors:

- Avoid tapping into your retirement investments or other long-term saving goals to fund your crypto investment.

- Invest with caution. And only invest what you can afford to lose.

- Consult with a trusted investment professional to help you.

- Consider buying crypto for a lower price during one of the frequent dips in the market.

- There are still a lot of unknowns with cryptocurrency.

- Cryptocurrency is often targeted by scams. And the Federal Trade Commission warns that the U.S. government has no obligation to help if you’re a victim of crypto fraud.

Your Dupaco Credit Union provides referrals to financial professionals of LPL Financial LLC (“LPL”) pursuant to an agreement that allows LPL to pay Dupaco Credit Union for these referrals. This creates an incentive for Dupaco Credit Union to make these referrals, resulting in a conflict of interest. Dupaco Credit Union is not a current client of LPL for brokerage or advisory services. Please read the LPL Financial Relationship Disclosure for more detailed information.

Dupaco Financial Services is a division of Dupaco Community Credit Union — the financial home you own — so you can rest assured that you're working with an organization that will act with your personal interest in mind. Dupaco Financial Services works with a national, full-service securities brokerage firm, LPL Financial, to make available top-of-the-line investment and insurance information and opportunities.

Securities and advisory services are offered through LPL Financial (LPL), a registered investment advisor and broker-dealer (member FINRA/SIPC). Insurance products are offered through LPL Financial or its licensed affiliates. Dupaco Community Credit Union and Dupaco Financial Services are not registered as a broker-dealer or investment advisor. Registered representatives of LPL offer products and services using Dupaco Financial Services, and may also be employees of Dupaco Community Credit Union. These products and services are being offered through LPL or its affiliates, which are separate entities from, and not affiliates of, Dupaco Community Credit Union or Dupaco Financial Services. Securities and insurance offered through LPL or its affiliates are:

![]()

The LPL Financial Registered Representatives associated with this site may only discuss and/or transact securities business with residents of the following states: Iowa, Wisconsin and Illinois.