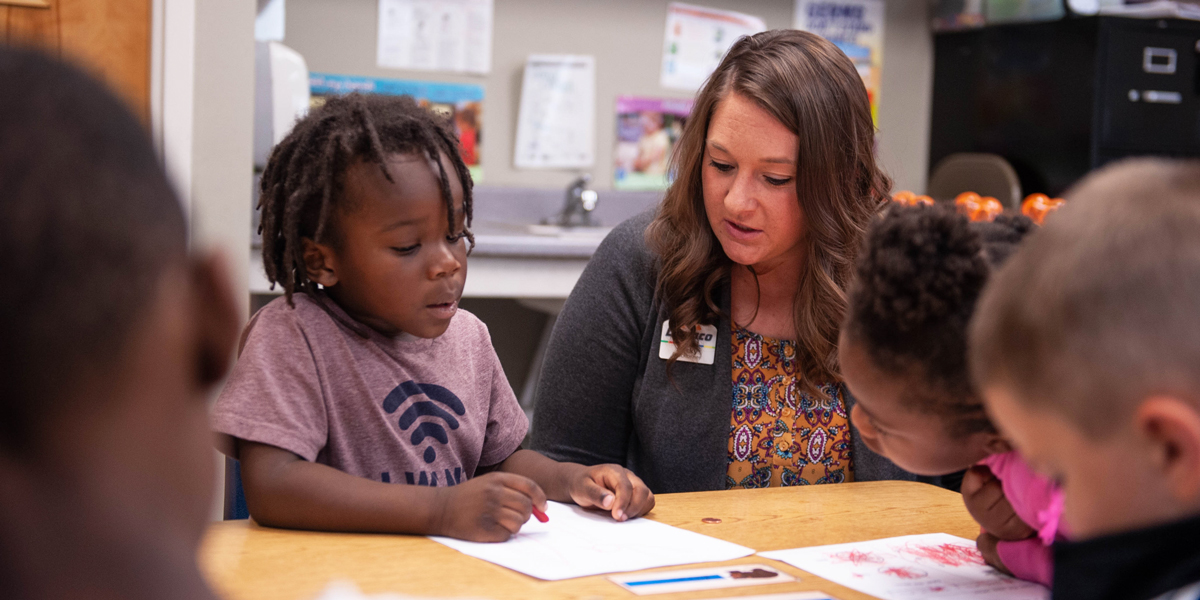

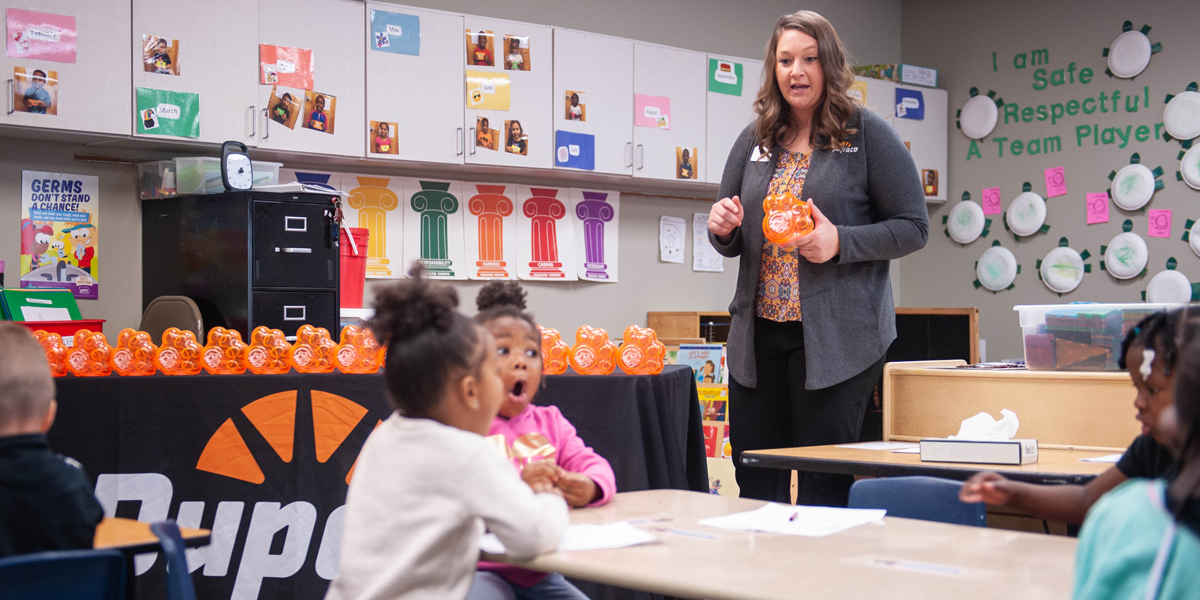

Dupaco’s Becky Beschorner works with Vahni Bethea during a financial literacy lesson at Tri-County Head Start on Oct. 9 in Waterloo, Iowa. (M. Blondin/Dupaco photo)

Dupaco’s Becky Beschorner works with Vahni Bethea during a financial literacy lesson at Tri-County Head Start on Oct. 9 in Waterloo, Iowa. (M. Blondin/Dupaco photo)

Financial literacy for kids to help empower more families

WATERLOO, Iowa—Most kids have a general idea about money.

“I keep it in my pocket,” a little boy recently told Dupaco’s Becky Beschorner.

At an early age, kids can start learning how money works.

And a three-way partnership has set out to do just that—teaching 3- and 4-year-olds the value of money and saving to put them on a path to financial wellness. The initiative focuses on financial literacy for kids in Head Start classrooms in Waterloo. It also jump-starts the children’s savings accounts by providing their first deposits.

The program is already showing early signs of success, empowering more families to save for their future.

Financial literacy for kids

“It starts with me!” will teach 200 Head Start children about money and help them start saving. It’s a joint endeavor between Dupaco, Tri-County Child and Family Development Council and the TruStage Foundation.

Beschorner, lead community outreach and education representative at Dupaco, will lead a monthly series of money lessons, covering everything from where money comes from to how to spend and save it. The series kicked off Oct. 9 in a Tri-County Head Start classroom at Waterloo’s Eastside Ministerial Alliance building.

Learn tips for teaching your kids how to spend, save and share

“Do you know what money is?” Beschorner asked the dozen children.

A child volunteered that he keeps it in his pocket.

“They’ve heard of money, but they don’t understand the concept,” Beschorner said. “We started with the penny, and we’ll work our way through all of the coins and get into how many coins equal a dollar.”

During the first lesson, each child received a Dupaco piggy bank and a penny to put in it. The kids can bring their coins from home to start growing their savings.

At the end of the educational series, the children can add their coins to their Dupaco savings accounts. As their parents continue to open the accounts, the TruStage Foundation seeds each one with their first $25.

“We at Tri-County Head Start know we are the beginning of these Iowa children’s formal education process,” said John Berry, CEO and executive director of Tri-County. “Our collaboration with Dupaco and the TruStage Foundation is proving to be a powerful, transformative partnership, given the multi-complex challenges that these children will face.”

Check out the Waterloo-Cedar Falls Courier’s coverage of the kickoff lesson

An evolving partnership

Dupaco’s partnership with Tri-County began three years ago, when the credit union’s community outreach and education team started working with the organization’s employees.

The team brings the credit union philosophy of people helping people to workplaces in the community—giving employees access to financial education and services where they work. Dupaco began providing financial guidance and services to Tri-County employees during staff meetings.

As the partnership evolved, the nonprofit organizations realized they could make an even bigger impact by extending financial services and education to the children and families that Tri-County serves.

Dupaco’s outreach team started attending Tri-County’s monthly family fun nights in the community, serving as a financial resource for attendees. And the Dupaco RW Hoefer Foundation turbo-charged the credit union’s efforts by providing tablets to Tri-County classrooms, helping enrich the children’s learning experiences.

“We’ve been working with the staff, the kiddos and the kids’ parents. It’s been a trifecta,” Beschorner said.

When it comes to helping families achieve their dreams, and break generational poverty, financial literacy is key, Berry said. Thanks to the partnership, more Tri-County families are getting opportunities to break away from a paycheck-to-paycheck cycle by learning about thrift, budgeting, saving, credit history and goal setting.

The latest initiative—financial literacy for kids in the classroom—further supports Dupaco’s education-rooted mission, said Michelle Becwar, Dupaco’s partnership development supervisor.

“This partnership allows for that holistic approach to help empower individuals through financial education and affordable financial services,” she said. “By teaching kids the value of money and how to save, it will help the children and their families develop healthy money behaviors to improve their financial positions.”

‘It’s working’

The latest efforts are already paying off.

Literally.

During the past few months, more than 50 Tri-County kids have established Dupaco savings accounts, each seeded with $25 from the TruStage Foundation, Beschorner said.

Not only that, but the families are already saving even more on their own. So far, participating families have saved an additional $1,200 through a combination of systematic saving and periodic deposits, Beschorner said.

“It’s working. This is what we wanted to happen,” she said.

Many parents are automatically saving a set amount for their children each time they’re paid. Automatic deposits range from a dollar to $25.

But the amount isn’t what’s important right now, Beschorner said.

“No matter the dollar amount, they’re getting into the habit of saving and realizing, ‘I can save for my child’s future,’” she said. “Even if it’s a dollar, that’s one extra dollar they weren’t saving before.”

Connecting with these children while they’re still young can help solidify healthy money habits. It also can spark important family conversations at home.

“It’s never too early to start having conversations about how money works,” Beschorner said. “At this point, we just want to let them know they can talk about money and let them know there is a financial home here to help them.”