Your savings account options

Go ahead, save your money your way

Looking to save for something special? Or building a financial cushion for the future? Whatever your goals, you have options to save your way—with the peace of mind that your money is federally insured.

Account types

Compare and choose the best type of savings account for you

Features

These helpful tools are just the beginning

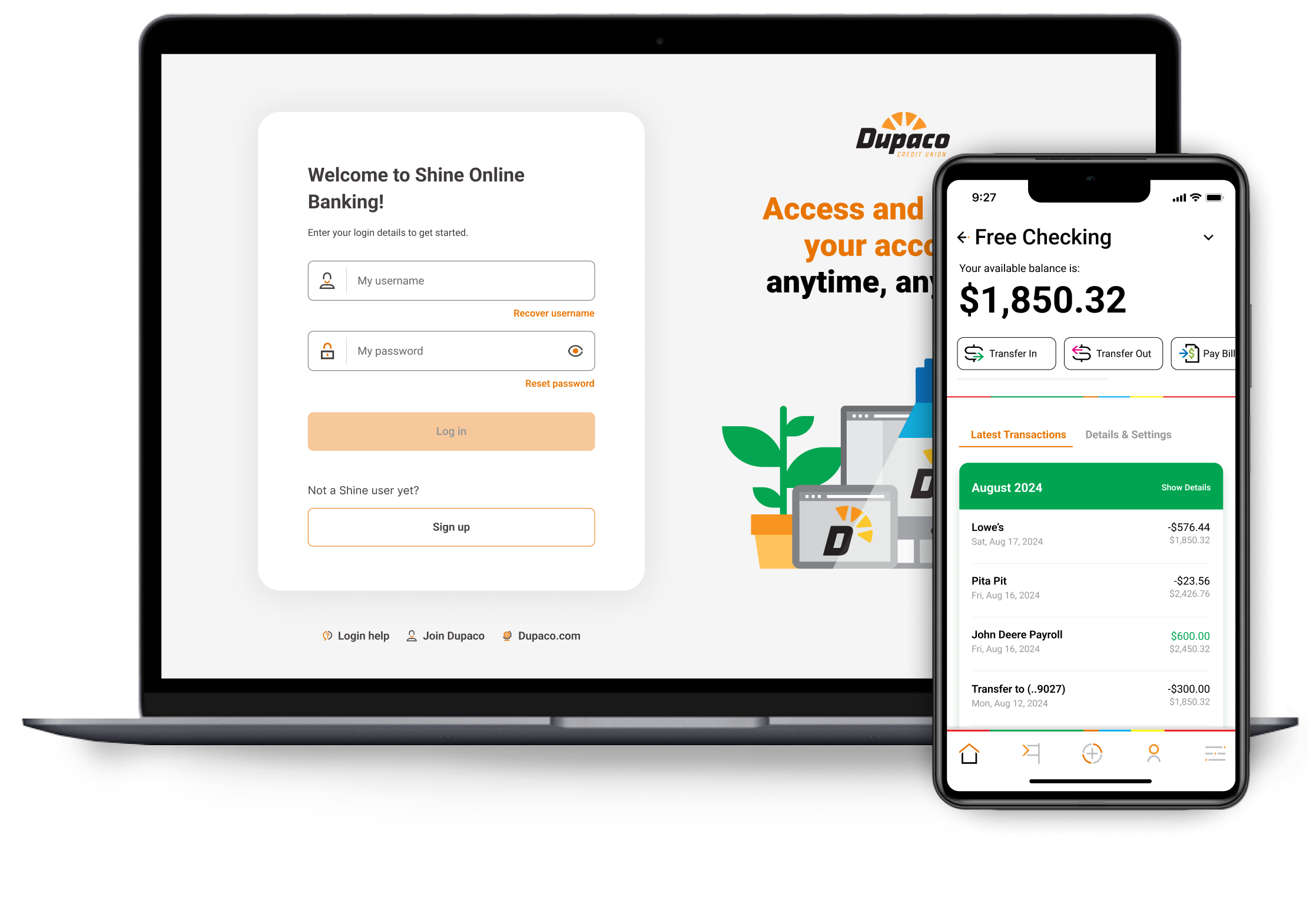

Digital banking

All your accounts, at your fingertips

Stay in-the-know as you go. Keep tabs on your spending, transfer funds, pay bills and more with Dupaco’s free Shine Online and Mobile Banking.

Savings calculators

Crunch the numbers

Use our free savings calculators to see how your savings can grow, set goals for your next purchase and figure out how much you can save each month.