Mortgage scam postcards and texts: How to tell if it’s really Dupaco

Updated Sept. 23, 2025, at 10:36 a.m. CT

If you’ve received a postcard, letter or text that looks like it’s from Dupaco Credit Union, you might be wondering if it’s legit. And you’re not alone.

Many homeowners have reported getting messages about their mortgage that seem urgent or “time-sensitive” but don’t actually come from us. And the mortgage information wasn’t provided by your credit union.

These messages are a type of mortgage scam designed to look official and trick you into calling a number, clicking a link or sharing personal information.

Here’s how they work, what to look for and how to stay protected.

How mortgage scam postcards and texts work

Scammers often use your mortgage information, which is public record, to send you official-looking mail or texts.

The goal? To convince you that you need to act quickly and call them back.

Some claim to be about “mortgage protection insurance” or “payoff coverage.” (Dupaco offers its own Payment Protection for loans.) Others might say your loan has been “approved” or that a “report” about your property is ready.

While the details may vary, the red flags are usually the same: Vague language, urgent wording and instructions to respond right away.

What do fake mortgage mailings look like?

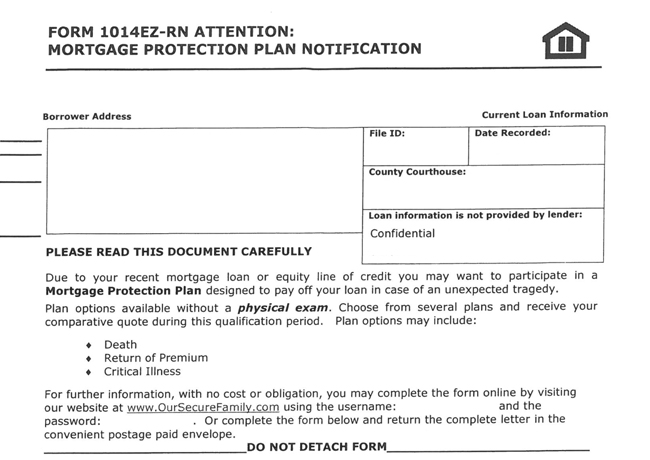

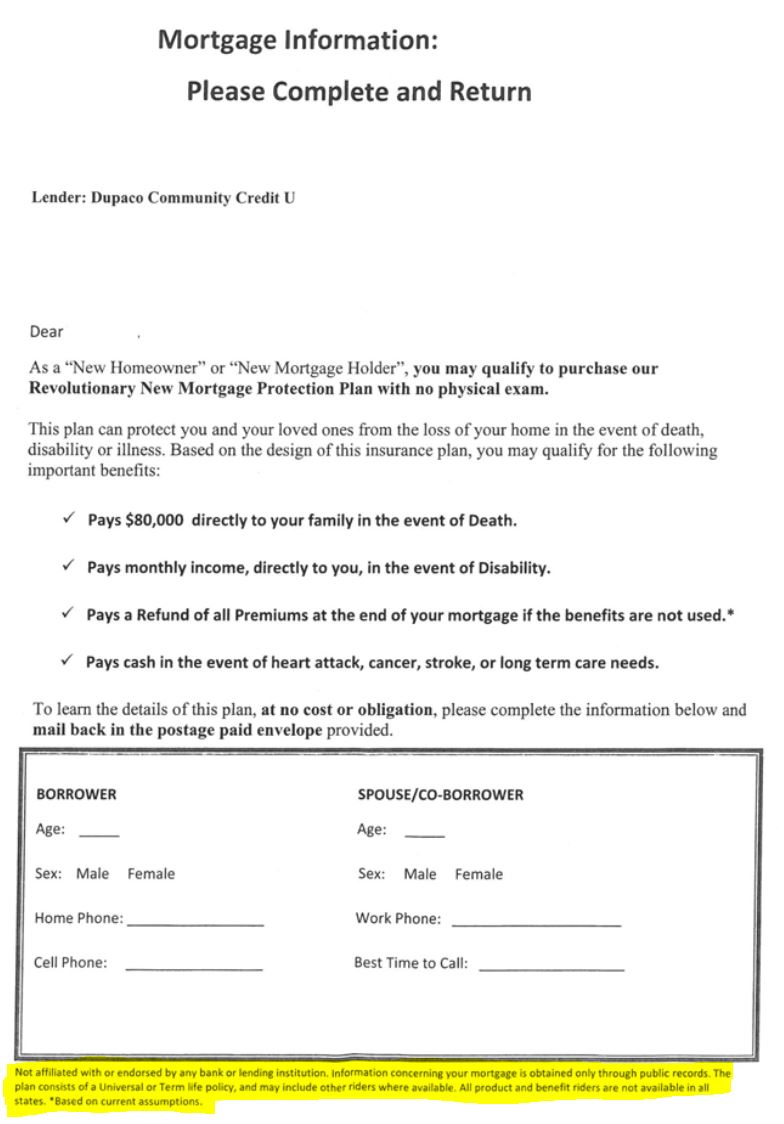

One member shared a mailing that looked like this:

IMPORTANT NOTICE:

RESPONSE NEEDED

You have recently closed on this mortgage with DUPACO COMMUNITY CU. We need you to please call us about an important matter regarding this loan. This is time sensitive so please call us at … as soon as possible.

The letter also includes a “mortgage ID number,” looking extra official. But in the fine print, it revealed it was from a third-party company—NOT Dupaco.

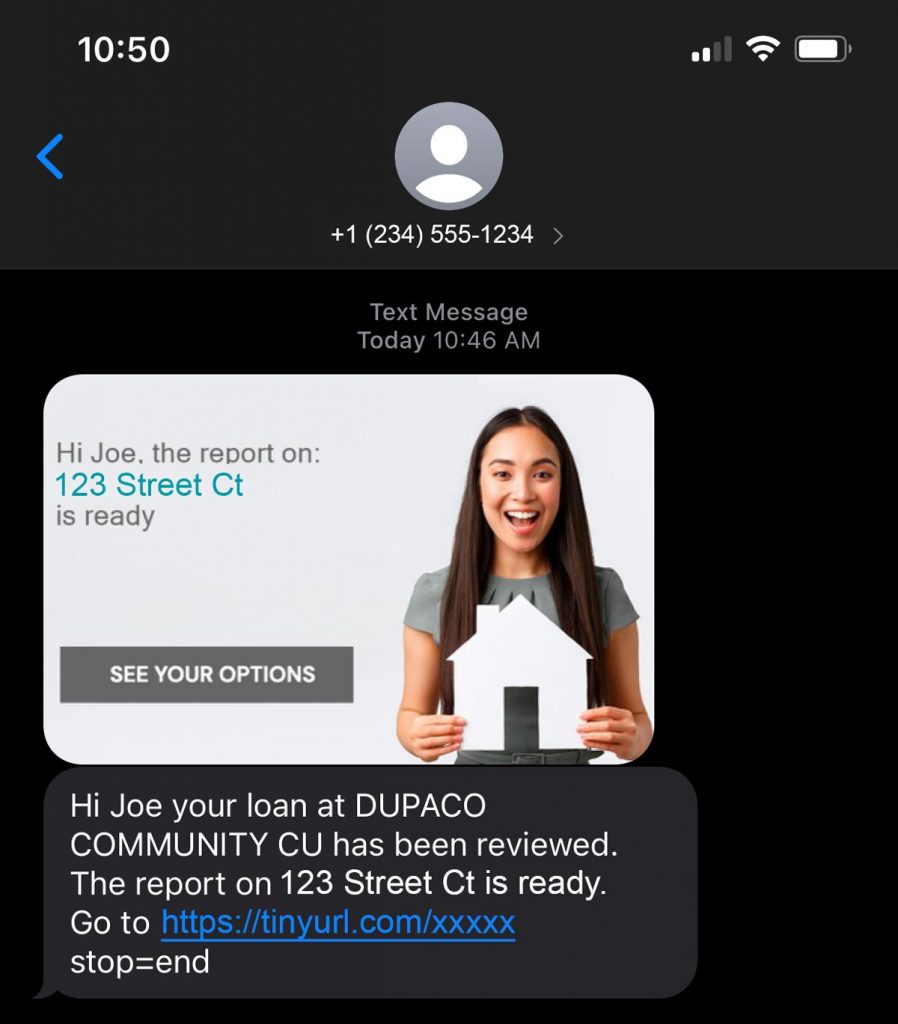

What do scam texts look like?

Another Dupaco member received a text message that said: Hi, (your name) your loan at DUPACO COMMUNITY CU has been reviewed. The report on (your address) is ready. Go to …

The text instructs you to click a link to access the report.

Dupaco did NOT send this text to you.

Why did I get this postcard or text?

You may be wondering, how did they even get my info?

Mortgages are public record, which means companies can search recorded mortgages and target homeowners with these offers. They use this as a “shotgun approach,” sending a bunch of mailings or texts hoping that some people respond.

They’re not affiliated with your credit union, even if they use its name or reference your mortgage.

How does Dupaco really contact members?

Dupaco uses a variety of ways to communicate with members, including:

- U.S. mail

- Phone

- Messages within Shine Online and Mobile Banking

But we won’t send you private information on a postcard.

When in doubt, call Dupaco directly.

Learn more about how Dupaco communicates >

What to do if you receive a suspicious message

If you think you’ve received a mortgage scam postcard or text:

- Don’t respond: Avoid calling the number, scanning a QR code or clicking any links.

- Contact us directly: Call Dupaco directly at 800-373-7600. We’ll confirm whether a message is real.

- Report it: You can also file a complaint with your state’s consumer protection office or the Federal Trade Commission.

- Stay alert: Keep an eye on your credit and accounts for unusual activity.

See how to monitor your credit for free with Bright Track Credit Monitoring >

Protect yourself from future scams

Fraud tactics are always evolving. Scammers may use mail, phone calls, texts or even websites designed to look like your credit union.

The best protection is knowing the signs and remembering to pause:

- Urgency is a red flag.

- If it feels off, trust your gut.

- When in doubt, contact us directly.