Lease vs. finance a car: How to decide what’s right for you

Updated Sept. 19, 2025, at 11:20 a.m. CT

If you’re shopping for a car, you might be asking yourself: Should I lease or finance?

At first glance, leasing looks cheaper—those low monthly payments are tempting. But over time, financing might save you more money.

The right choice depends on your budget, lifestyle and future plans. In this guide, we’ll break down the differences, answer common questions and help you figure out what’s best for you.

Lease vs. finance: What’s the difference?

On the surface, the differences between leasing and buying a vehicle seem straightforward:

- Length of time: Leasing a car means you’ll usually have access to a new set of wheels every few years; buying usually means you plan to drive the same car for much longer.

- Repairs: Leasing typically includes a warranty covering most repairs; buying means accepting higher repair costs as the car ages.

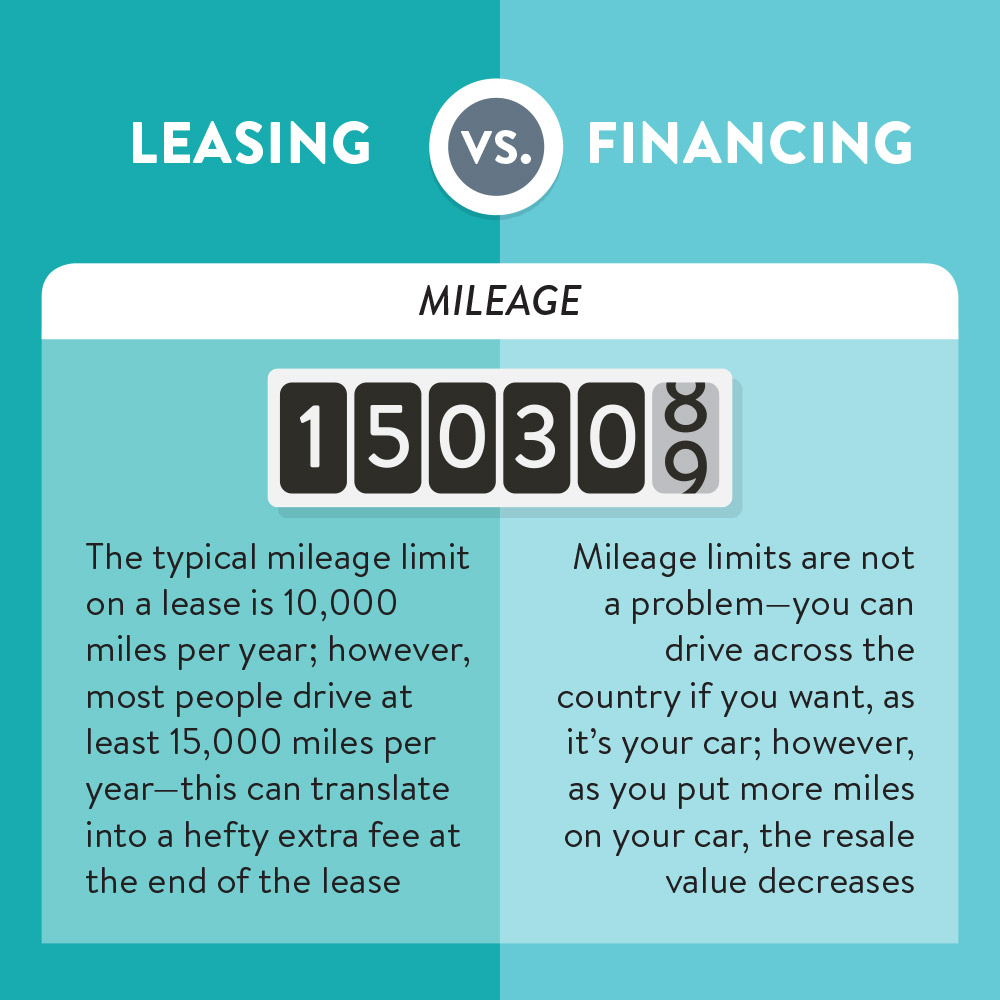

- Mileage and customization: Leasing agreements can limit your mileage and customization options; buying means you can drive as much as you want and customize it however you’d like.

Looking only at the comparisons, buying might seem more practical. But if that’s the case, why are lease payments so much lower (often 30-40% less) than loan payments? And why is leasing still considered more expensive in the long run?

The answer: Depreciation.

Try our buying vs. leasing a vehicle calculator >

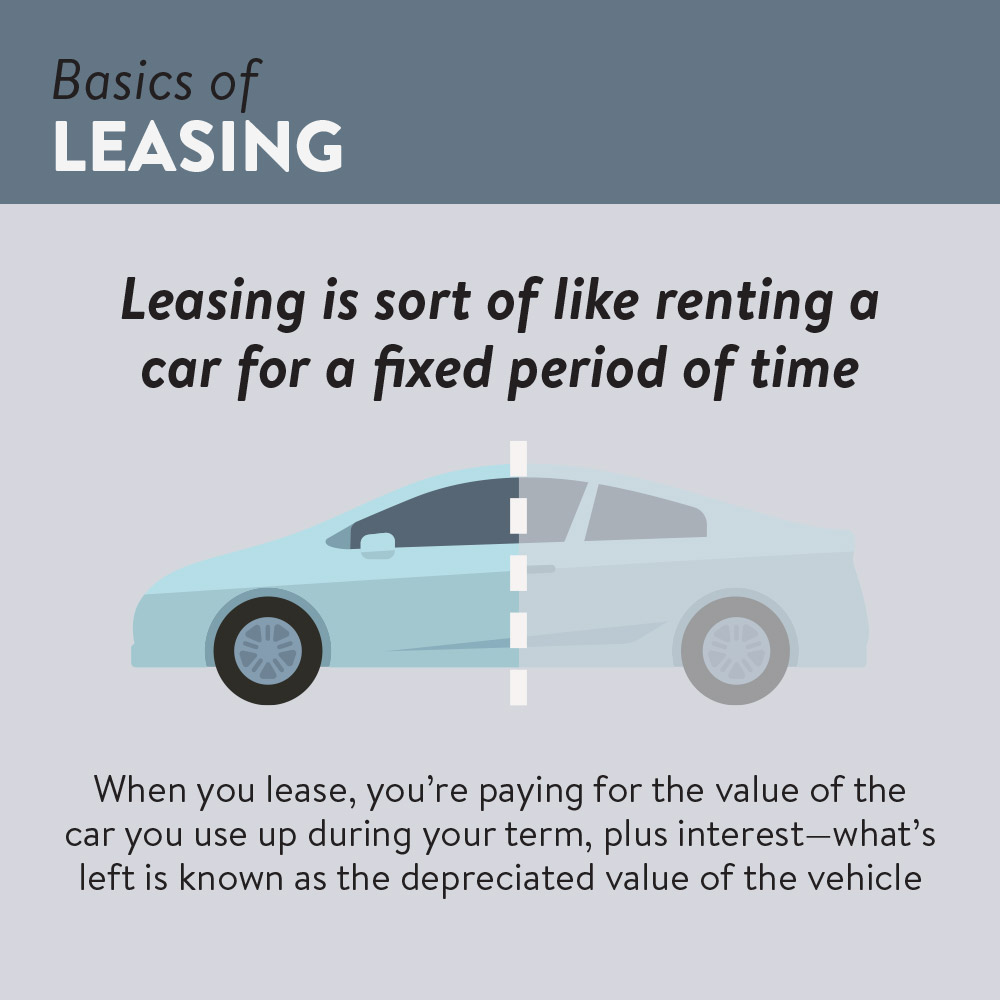

How depreciation fits in

Every car loses value, or depreciates, over time. In fact, a car can lose thousands of dollars in value the moment you drive it off the lot. The steepest drop happens in the first three to five years.

Here’s how the decline usually looks:

- Brand new to 5 years old: The car depreciates by 15-20% of its value each year.

- 5 to 10 years: Depreciation slows to about 10-15% annually.

- 10+ years: It levels out to less than 5% a year. By this time, the car is usually worth less than one-fifth of its retail price!

So, what does mean for your wallet?

- When you lease: Your monthly payments cover that steep early drop in value. You’re essentially paying for the portion of the car you “use up,” without owning anything at the end.

- When you finance: You take the depreciation hit too. But once the loan is paid off, you own the remaining value. If you sell or trade in the car, some money comes back to you.

Put simply: Leasing keeps payments lower up front, while financing lets you recover some value later.

When leasing might make sense

Leasing can be appealing if you value convenience and predictability. You’ll likely have lower monthly payments, the chance to drive a new car every few years and fewer worries about major repairs. The trade-off? Rules around mileage, wear-and-tear and no ownership at the end.

You might lean toward leasing if you:

- Want a new car every few years.

- Prefer lower monthly payments.

- Drive fewer miles each year.

- Like the idea of warranty coverage handling most repairs.

- Don’t mind mileage or customization limits.

Dupaco’s Mini-Max is a lease-like loan that gives you more options >

When financing might be better

Financing usually makes more sense if you’re in it for the long haul. Your monthly payments might be higher at first, but they eventually end—leaving you with a car you own outright.

That ownership gives you more freedom: You can keep the car for years without payments, sell it, trade it in or even refinance if interest rates drop.

You might prefer financing if you:

- Plan to keep your car for six-plus years.

- Want to build equity in your vehicle.

- Drive long distances and don’t want mileage restrictions.

- Like the freedom to customize or modify your car.

- Want the long-term savings of owning a paid-off vehicle.

Use our free resources to help you find your next car >

Questions to ask yourself

As with any major financial decision, it helps to be realistic about your budget and honest about your lifestyle.

To help you figure out what’s most important to you as a new car owner, you can ask yourself:

- How long do I plan to keep this car?

- What’s more important: Lower payments now or lower total cost over time?

- How much do I drive each year?

- Am I comfortable with mileage limits and wear-and-tear rules?

- Am I prepared to pay for car repairs?

- Do I want to own my car outright one day?

The bottom line

Leasing can make sense if you want lower monthly payments and a new car every few years. Financing is better if you want ownership and long-term savings.

No matter which route you take, the key is choosing what fits your budget, lifestyle and goals.