Mobile wallets: A simple guide to faster, safer payments

Mobile wallets have been around for a while, but if you’ve been holding out on trying one, now might be the perfect time to take the plunge.

With about 9 in 10 Americans owning smartphones, contactless payments by mobile wallet aren’t just a tech trend—they’re becoming a more regular part of how people pay.

In fact, tap-to-pay purchases using Apple Pay, Samsung Pay and Google Pay are already approaching $300 billion in the U.S., and that number is expected to more than double in the next few years, according to the Consumer Financial Protection Bureau.

Here’s what you need to know if you’re curious about what mobile wallets are, how they work and whether they’re worth the switch.

What is a mobile wallet?

A mobile wallet (or digital wallet) is exactly what it sounds like: A secure, digital version of your physical wallet.

Instead of fumbling for your debit or credit card in a checkout line, you can store your cards on your smartphone or smartwatch and tap to pay wherever contactless payments are accepted.

You’ll just need to use your phone’s mobile wallet app—Google Pay, Apple Pay or Samsung Pay—and add your Dupaco cards.

Once you’ve set it up, you’re good to go in stores, online or even in your favorite apps.

Why mobile wallets are worth considering

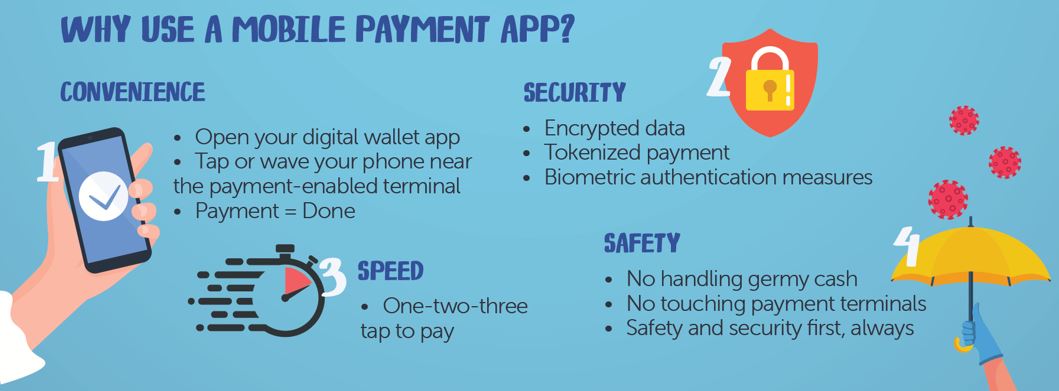

You probably already carry your phone everywhere, so why not use it to pay? Here’s why mobile wallets are quickly becoming a go-to payment option:

They’re safer than your physical wallet

Mobile wallets don’t just offer convenience—they bring extra security against card fraud.

Every time you pay, your actual card number isn’t used. Instead, mobile wallets use something called tokenization, which sends a unique, one-time code to the retailer for each transaction. Your card number stays private, and your data stays protected.

“So, if there would ever be a data breach at the retailer, the real card data is not compromised,” said Jim Bemboom, assistant vice president, card services at Dupaco. “If a retailer accepts a mobile wallet, the transactions are very safe.”

They also use biometric features—like fingerprint scans or facial recognition—to approve purchases. That means even if someone finds your phone, they can’t just start shopping with it.

“Always have a passcode or fingerprint enabled on any device with a card loaded into one of the mobile wallets,” Bemboom said. “Since mobile devices can hold a lot of sensitive data besides card numbers, they should be safeguarded as much as possible.”

Resist the temptation to share your passcode with others.

They’re convenient

You don’t have to dig through your purse or wallet. Just tap your phone and go.

Plus, mobile wallets work with devices you already use—like smartwatches—and they’re accepted in more places than ever.

Look for the contactless payment symbol at checkout, or use your wallet online when shopping from your couch.

They’re fast

No swiping, inserting or waiting. Just one tap and you’re done.

They can make budgeting easier

Most digital wallets integrate with money-management or banking apps, helping you track spending without a pile of paper receipts. And you can even receive digital receipts from many retailers.

Are there downsides to mobile wallets?

Like anything, mobile wallets come with a few things to keep in mind:

- You’ll want to make sure your phone (and your app) is locked down with strong passcodes or biometrics.

- Not every store is contactless-ready—yet. But the number is growing.

- If your phone runs out of battery and you’re without a backup payment option, that latte might have to wait.

Still, these are small trade-offs for the added convenience and security.

What if I lose my phone?

Don’t panic. You’ll want to treat it like a lost or stolen card by calling your card provider right away.

“If the device is lost or stolen, please contact card services immediately,” Bemboom said. “We can deactivate the card in the mobile wallet so that it can’t be used.”

You can also log into your phone provider’s website to learn how to locate or remotely disable your phone.

Ready to give it a try?

Getting started is easy. Here’s how to set up your mobile wallet.

Open or download the mobile wallet app that works with your device:

Pro tip: Set your Dupaco card as your default card in your wallet for even more convenience.

From there, your phone becomes your wallet. You’re all set to pay in-store, online or wherever life takes you!