Moving soon? Here’s how to get organized for your move

Updated Sept. 12, 2025, at 1:08 p.m. CT

When Dupaco Credit Union’s Katie Fisher moved cross-country with her toddler, three cats and a goldfish, she quickly realized that moving as an adult—especially with family—takes serious planning.

But with detailed moving checklists and smart preparation, she was able to walk right into her new apartment with everything ready.

If you have an upcoming move, Fisher’s experience shows that planning ahead and staying organized makes all the difference. Here’s a guide full of practical tips to help you save time, protect your money and avoid last-minute stress and unexpected costs.

How to plan a move: Start with a moving checklist

The first step to a smooth move is making your moving checklist. Break your tasks down by weeks or months before your move:

- Sort, declutter and donate items you no longer need

- Pack boxes by category and clearly label them

- Set a budget for moving expenses, including moving supplies, truck rentals and any temporary housing costs

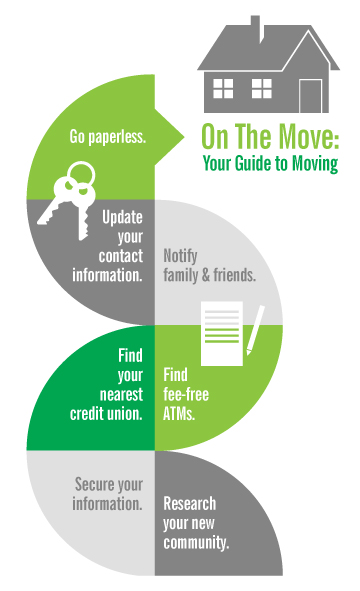

Go paperless and automate your bills

Going paperless can save you time and reduce the risk of missed bills or important mail.

“As much as you’re comfortable with the idea, go paperless with your accounts,” Fisher said. “In the event you forget to notify someone of your new address, your accounts will be safe.”

Here are some ideas to help you get started:

- Sign up for eStatements and digital alerts with your credit union.

- Use Bill Pay or automatic payments for utilities, subscriptions and recurring bills.

- Keep a digital record of important accounts and passwords for easy reference.

This step not only saves paper but ensures your financial information stays secure during a busy move.

Turn on your eStatements in Shine Online or Mobile Banking >

Who do you need to notify when you move?

When you move, updating your contact information is critical.

Start with the U.S. Postal Service and request your mail to be forwarded to your new address. Then work your way down the list:

- Electric, gas and water companies (Call both your current and new utility companies a couple of weeks before moving to ensure your services are stopped and started on time.)

- Phone, internet and TV providers

- Credit union (This is especially important when activating your Dupaco debit or Visa credit cards. You need to call from the number listed on your account.)

- Credit card companies

- Investment firms

- Department of Transportation (driver’s license and vehicle registration)

- Employer

- Children’s schools and childcare providers

- Health care providers (doctors, dentists, optometrists)

- Insurance companies (home, auto, health, life, disability)

- Subscription services and memberships

“Don’t wait until the last minute,” Fisher said. “If you wait for the next bill, it might not make it to you. I don’t take any chances with my personal information floating out there.”

Keep family and friends in the loop

Notify friends and family of your move early.

Share your new address and any temporary contact information. Staying connected can save headaches with deliveries, invitations or important messages.

Find ways to access your money

Before you move, locate your closest credit union branch.

You also can use Dupaco’s mobile app to find nearby ATMs. You can use your Dupaco MoneyCard in ATMs of other participating Privileged Status and CO-OP financial institutions without paying surcharge fees.

Find your closest branch, ATM or shared branch >

Protect your personal information

Before packing, you’ll want to secure sensitive documents like:

- Social Security cards

- Financial statements

- Identification

Keep them organized in a dedicated folder, so you can access them quickly without risk of loss or theft.

“You want to know exactly where that important stuff is,” Fisher said.

Research your new community

Learning about your new city can make your transition smoother. You can:

- Explore local services, grocery stores and healthcare providers online

- Ask friends, coworkers or neighbors for recommendations

- Check out schools, libraries, parks and community centers if you have children

And don’t hesitate to ask your credit union, Fisher said.

“We are professionals. And, yes, we handle finances. But we’re also people. We’re parents,” she said. “I like to think that my members think of me as a friend too.”

Bonus money-saving moving tips

Moving costs can add up fast. But these tips could help lessen some of those expenses:

- DIY vs. moving company: Compare costs to decide what works for your budget.

- Reusable packing materials: Collect boxes from grocery stores, U-Haul locations or friends and family.

- Donate or sell items: Less stuff to move saves time and money.

- Track expenses: Use an app or spreadsheet to avoid surprises.