How to avoid bank fees (and keep more of your money)

Updated Sept. 8, 2025, at 11:45 a.m. CT

Mistakes happen to the best of us. If you’ve ever overdrawn on your account or been hit with an ATM or late-payment fee, you’re not alone.

In fact, consumers paid an estimated $12.1 billion in overdraft and non-sufficient funds fees in 2024, according to data analyzed by the Financial Health Network.

“Almost all consumers get hit with a fee at least once,” said Dupaco Credit Union’s Katie Shemak. “It could be something as simple as miscalculating your account balance or having an emergency and needing quick access to cash.”

But if you’re paying more than the occasional fee, it might be time to reevaluate your money habits so you can keep more of your hard-earned money working for you.

Here’s a breakdown of common fees—and smart steps you can take to break the fee cycle.

Common bank fees to watch out for

Before you can avoid fees, it helps to know what to look out for:

- Overdraft and non-sufficient funds fees: Charged when your account balance goes negative.

- ATM fees: Out-of-network withdrawals charged per transaction.

- Monthly maintenance fees: Some accounts require minimum balances or direct deposit to avoid them.

- Late payment fees: For missing credit card, loan or bill payment deadlines.

- Foreign transaction or wire transfer fees: Often a percentage of your purchase amount when traveling internationally.

8 ways to avoid bank fees

The good news? With a few smart money habits (and some built-in credit union tools), you could sidestep many of these fees.

|1| Get a Money Makeover

Sometimes, the best way to stop paying fees is to zoom out and look at your financial habits.

A free Dupaco Money Makeover could help you review your budget, spot spending leaks and find ways to break the fee cycle.

Request a free Money Makeover >

Plus, if you use Dupaco’s Shine Online and Mobile Banking, the built-in budgeting tools automatically track your spending and saving. And the more you use your accounts, the smarter the personalized tips become. This makes it easier to spot budget leaks.

|2| Balance your accounts

Checking your account statements is good practice, but don’t stop there.

Review your pending transactions—those are often the culprits behind accidental overdrafts.

|3| Track your accounts with alerts

With Dupaco’s eNotifier Alerts, you can get real-time notifications for things like:

- Low balances

- Deposits

- Large withdrawals

For example, set an alert when your balance dips below $100 so you’ll know before it’s too late.

“We live in a fast-paced technological world now, and money is moving faster,” Shemak said. “Wait to initiate any transactions until funds are available in the account.”

|4| Use fee-free ATMs

Nothing stings like paying $5 just to grab your own money.

The good news: Dupaco members never pay surcharges or transaction charges when using your MoneyCard debit card at Dupaco-owned ATMs. Plus, you can avoid surcharge fees by using your debit card at Privileged Status and CO-OP ATM Network locations.

|5| Automate your payments

Late fees add up quickly, and they’re among the easiest to avoid. With Dupaco’s Bill Pay, you can automate your recurring bills so they’re always on time.

|6| Link to a savings account for overdraft protection

Everyone makes mistakes. That’s why linking your checking to a savings account could help cushion them.

With Overdraft Protection, Dupaco can automatically transfer funds from your savings if your checking account balance dips too low to cover a transaction.

It’s a small safety net that could save you from a much bigger fee.

|7| Review your account options

Not all accounts are created equal.

Some checking accounts are designed to be fee-free if you maintain a low balance or rely on direct deposit. Review your account options and see if another account type better matches your lifestyle.

Explore Dupaco’s checking accounts >

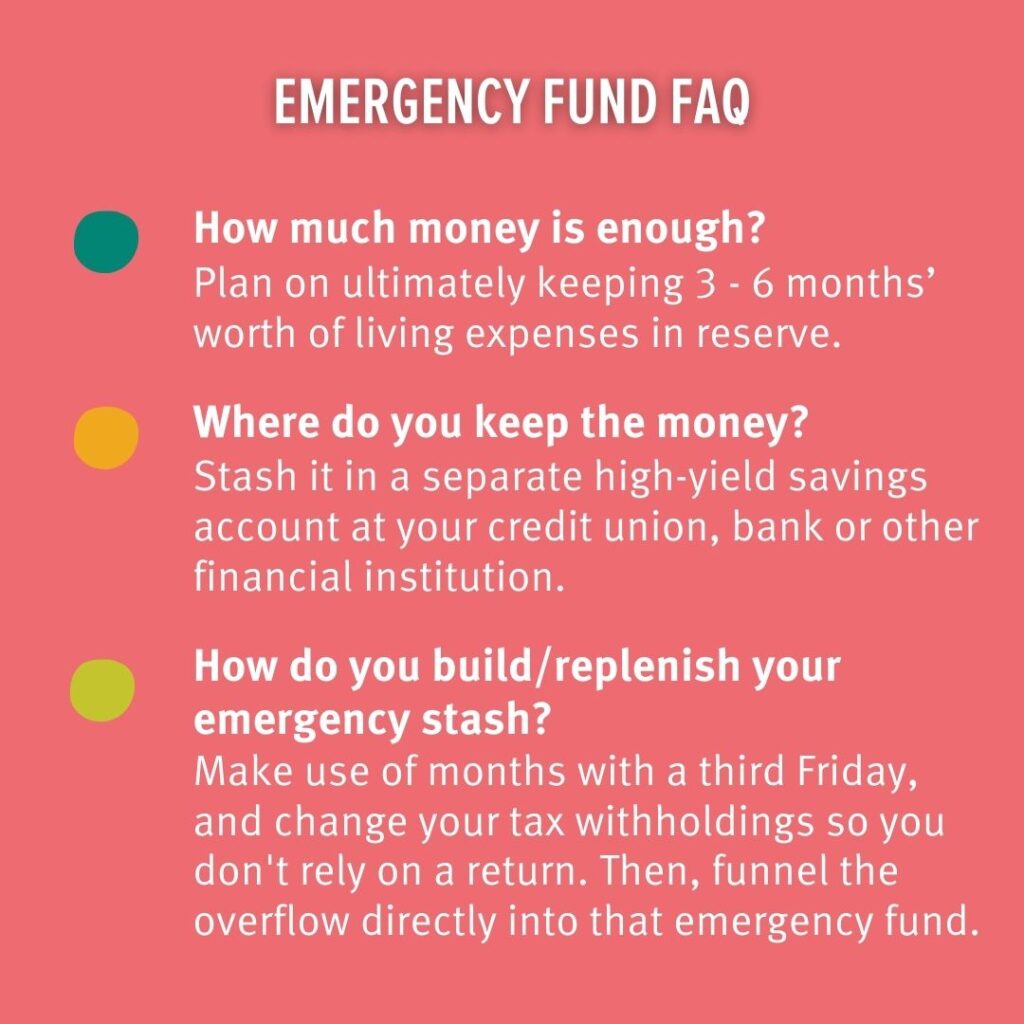

|8| Build an emergency fund

Unexpected expenses are one of the biggest reasons people overdraft.

Setting aside some money in a savings account can act as a buffer and prevent fees when life throws curveballs.

Learn how to build your emergency fund >

Final thought: Keep more of your money

Financial fees don’t have to be an inevitable part of life. With a mix of smart money habits and tools like eNotifier Alerts, Bill Pay, fee-free ATMs and overdraft protection, you can keep more of your money where it belongs—working for you.