What's it all about?

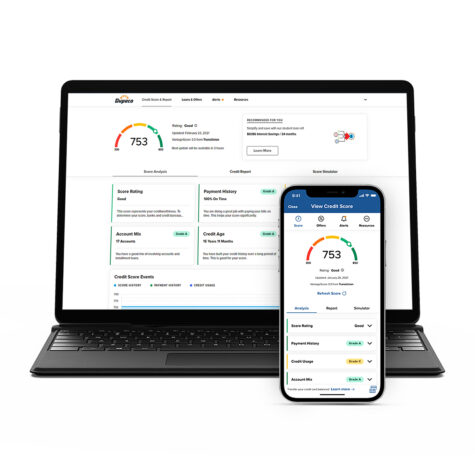

Did you know? Bright Track Credit Monitoring is one of Dupaco’s free money management tools available in the Bright Track Financial Wellness Hub. Log in or sign up for Shine Online & Mobile Banking to explore what else Bright Track has to offer!

Here's how to get started:

Step 1: Log in to your Shine Online or Mobile Banking account.

Step 2: Click on Bright Track under ‘My Perks’.

Step 3: Read and accept the terms and conditions of use.*

Step 4: Answer a few questions to verify your identity.

Hint: These are questions from your credit report and are only answers you should know.

That’s it! Now you’ll see your credit score on your account summary page each time you log in to Shine. To see details and recommendations, just click on your score.

*If you accept Bright Track’s terms and conditions of use within your Shine Online Banking account, AND you shared your Shine login credentials with your joint account owner, spouse, friend or family member, that person will be able to view your Bright Track credit score information. To DISABLE Bright Track access within your Shine Online Banking account, please contact us at 800-373-7600 or disable Bright Track access within Shine via the Profile tab. If you do not want to disable Bright Track, then no action is required.

Not a Dupaco member?

Open a Dupaco Share Savings account with as little as $25 and you’ll automatically become the newest Dupaco member-owner! In addition to Bright Track Credit Monitoring, a Dupaco membership gives you immediate access to many more benefits and perks. Opening your account is simple — follow the secure link below or stop into your nearest Dupaco branch.

Don’t have a Shine account?

No worries. We can help with that.