How to budget for a wedding: Save money on your big day

Updated Sept. 10, 2025, at 1:15 p.m. CT

Planning a wedding is one of life’s most exciting milestones. But let’s be honest, it can also be one of the most expensive. The Knot’s 2023 Real Weddings Study reported that the average U.S. wedding cost is around $35,000. That’s a hefty price tag for one day.

The good news? You don’t have to spend like the average to have an amazing celebration. With the right planning, budgeting and a little creativity, you can design a day that’s both memorable and financially manageable.

Here’s a step-by-step guide to budgeting for your wedding and saving money without sacrificing style.

How much should you budget for a wedding?

Every couple’s wedding budget will look different depending on your location, guest count and priorities. A simple courthouse ceremony might cost a few hundred dollars, while a big venue wedding could run into the tens of thousands.

A good starting point:

- Figure out what you can afford: Look at your savings, income, and any contributions from family.

- Decide your must-haves: Is it the dream photographer? A live band? A plated dinner? Allocate more of your budget there.

- Trim where it matters less: If flowers or favors aren’t a big deal to you, that’s where you can cut back.

Who pays for what in a wedding?

Traditionally, certain expenses were divided between families. But today there are no set rules. Some couples pay for everything themselves, while others receive help from parents or relatives.

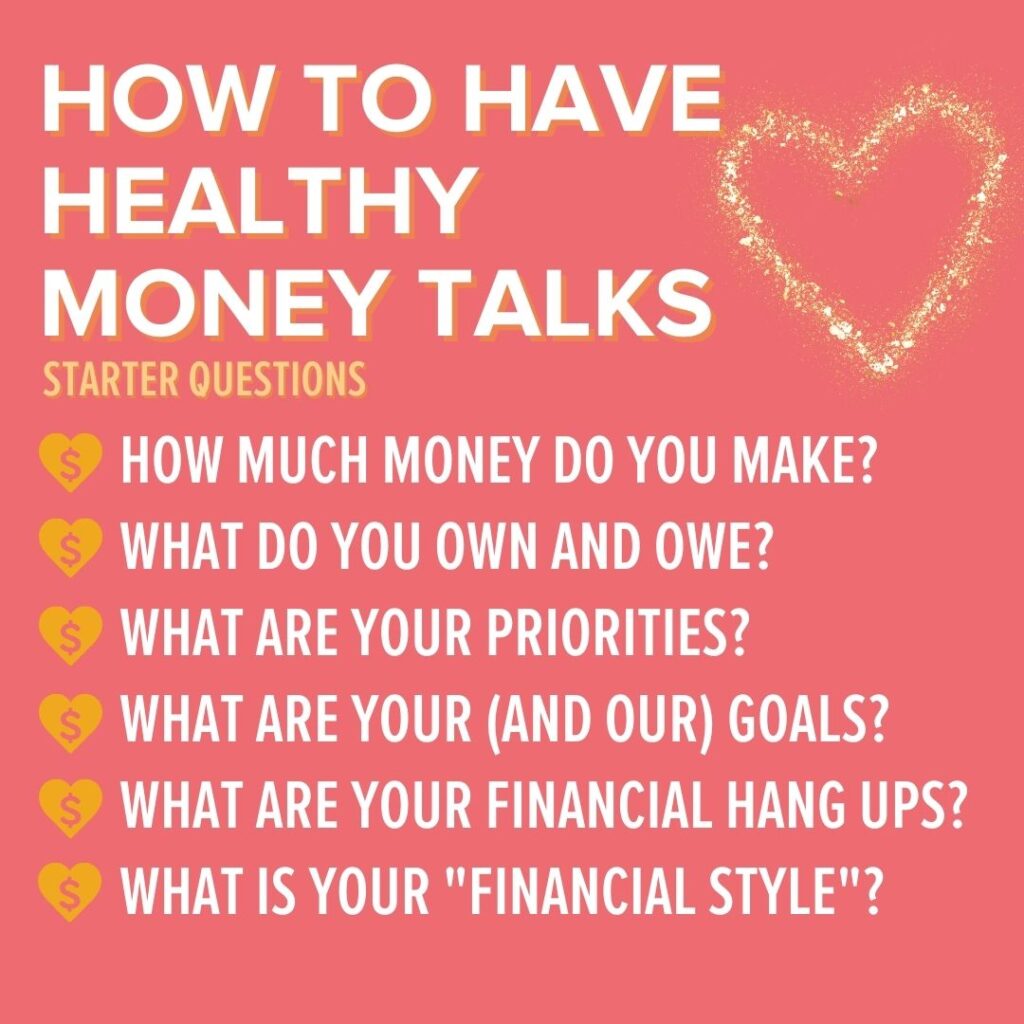

The key is open, honest conversations early on. Ask:

- How much can each person contribute?

- Are there specific items someone wants to cover (like the dress, rehearsal dinner or flowers)?

- Does anyone expect a say in decisions if they’re paying?

Once you know who’s paying for what, you can build your budget with confidence.

If you’re handling most of the expenses, consider a free Dupaco Money Makeover to help create a realistic plan.

What’s the cheapest way to plan a wedding?

If you’re trying to save money without feeling like you’re “cutting corners,” try these budget-friendly strategies:

- Think beyond Saturday: Venues might offer discounts for Friday, Sunday or off-season weddings.

- Combine ceremony and reception venues: One location means fewer contracts, less travel and potential savings on vendors.

- Shrink your guest list: Feeding 75 guests instead of 150 can cut your catering bill in half—and make the event more intimate.

- Tap into your network: Do you have a talented friend who bakes, DJs or designs invitations? You might be able to get a reduced rate or a heartfelt gift of service.

- Explore alternatives: Food trucks, buffet-style dining or dessert bars can be fun, cost-effective swaps for traditional sit-down dinners.

How can you cut wedding costs without sacrificing style?

Budget-friendly doesn’t have to mean boring.

Here are some creative ways to keep your wedding beautiful without overspending:

- Go green with flowers: Add more greenery than blooms to create lush arrangements at a lower cost.

- DIY wisely: Small projects (like table numbers or signage) can be fun. But don’t overwhelm yourself with 200 favors you’ll regret halfway through.

- Rethink the cake: Order a small display cake for photos and serve guests from a larger sheet cake behind the scenes.

- Rent or buy pre-loved: Wedding dresses, decor and even suits are easy to find secondhand or through rental boutiques.

- Choose your splurges: Spend on what will matter most in your memories (like photos or music) and cut back on what guests won’t remember a week later.

Should you borrow money for a wedding?

Ideally, you’ll save ahead of time. But if your budget gap feels overwhelming, some couples consider personal loans or even credit cards.

Before going this route:

- Compare interest rates.

- Borrow only what you can realistically repay.

- Weigh the trade-off: A smaller wedding now may be better than carrying debt into your marriage.

Don’t forget life after the wedding

Your wedding is just the beginning. As you plan, think beyond the big day:

- Set aside funds for your honeymoon (a short trip now and a dream trip later can help).

- Build a post-wedding emergency fund for unexpected expenses.

- Talk about long-term goals like buying a home, starting a family or retirement savings.

Starting your marriage on solid financial footing is one of the best gifts you can give each other.