What to do with your 401(k) from a previous employer

Updated on Oct. 14, 2025, at 10:35 a.m. CT

You’ve changed jobs—congratulations! But what about that 401(k) you left behind with your old employer?

If you’re like many people, your retirement savings might still be sitting there, quietly waiting for attention. Some people even forget they have an old 401(k). It happens!

Whether you’re looking to find that account, combine multiple 401(k)s or just understand your options, here’s a simple guide to help you make the most of your retirement savings. The best choice for you depends on your situation, your goals and what each employer’s retirement plan allows.

What are my options for a 401(k) from a previous job?

When you leave a job, your 401(k) money doesn’t go anywhere—it’s still yours. The good news is you have several ways to manage it. The best option depends on your financial goals and your old employer’s plan rules.

Here are the typical choices:

- Leave it where it is: You may be able to leave your retirement account where it is. If your balance is over $7,000, you can usually leave it in the 401(k) plan until the plan’s normal retirement age. But if your balance is under that amount, your former employer might ask you to move your money out of the plan.

- Roll it into your new employer’s 401(k): If your new job offers a 401(k) plan, you might be able to roll your old account into it. This could help keep your retirement savings in one place to simplify tracking your progress.

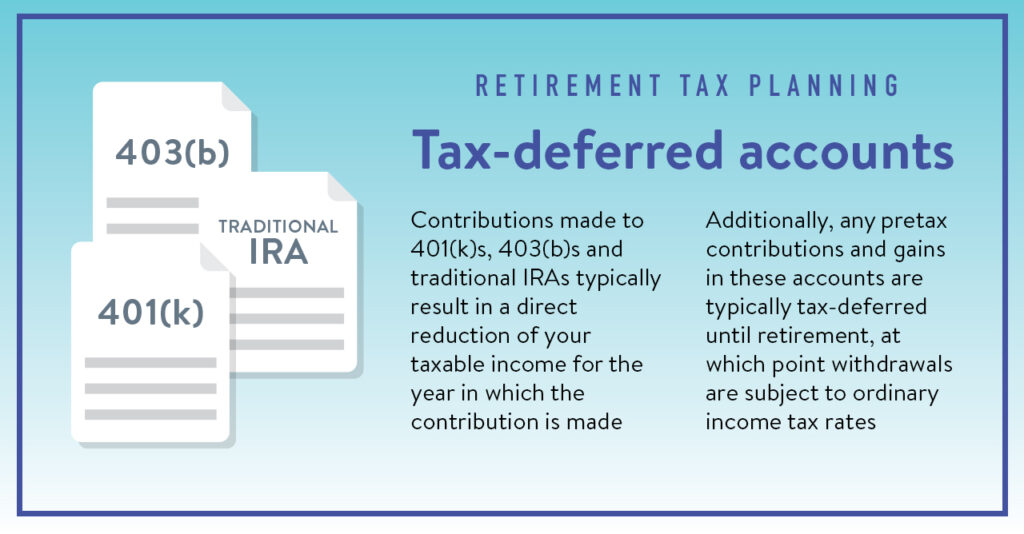

- Roll it to an IRA: An Individual Retirement Account (IRA) can be a smart way to consolidate your retirement savings and give you more control over your investments. This often offers more options than a workplace plan.

- Cash it out (with caution): Generally, if you withdraw money from a retirement plan or IRA before age 59½, it’s considered an early distribution. And unless an exception applies, you may have to pay additional taxes to access the money you’ve worked hard to save. Unless you absolutely need the funds, it’s often best to leave your money invested for your future.

Should I leave my 401(k) with my old employer?

It really depends on your financial situation and your former employer’s 401(k) plan rules. Sometimes leaving your money where it is can make sense—especially if your old plan offers solid investment options or low fees. Other times, moving your 401(k) gives you more control and flexibility over how you invest your money.

Here are a few reasons you might consider keeping your old 401(k) where it is:

- Protection from creditors: Many 401(k) plans offer federal protection from creditors. IRAs only offer this protection from creditors if you file for bankruptcy. Any added protection depends on your state’s laws.

- Access to loan: If you think you’ll need access to some of your funds, some 401(k) plans allow you to borrow against your balance. IRAs don’t offer that option.

- Employer stock advantages: If your old plan includes employer stock that’s gone up in value, special tax rules (called net unrealized appreciation) could make it beneficial to keep it there. You might qualify for favorable tax treatment on the capital gains, which wouldn’t apply if you moved it to an IRA. A tax advisor could help you weigh the pros and cons.

That said, many people choose to roll over their old 401(k) to make managing their retirement simpler.

Moving it to your new employer’s plan or an IRA could:

- Give you a clearer view of all your retirement savings in one place.

- Offer a wider range of investment options.

- Eliminate old account fees or paperwork.

- Make it easier to adjust contributions and allocations over time.

If you’re unsure which choice is right for you, talking with a financial expert could help you decide which route best supports your goals.

What should I know before rolling over my 401(k)?

If you decide a rollover makes sense, the good news is that it’s a common process. But before you start, it’s worth understanding a few key details that can affect how smoothly it goes and how your savings are taxed.

Here’s what to keep in mind:

- Check for fees: Ask if your old plan imposes any surrender charges, and find out if your new IRA has any as well. (Hint: Dupaco IRAs don’t charge maintenance fees!)

- Compare costs: Review the investment fees and expenses in your old plan versus a new IRA.

- Watch out for taxes: When done correctly as a direct rollover (plan-to-plan transfer), you won’t owe taxes on the amount moved. But if you receive the funds directly and then deposit them yourself, you’ll typically have 60 days to roll them over—or you could face taxes and penalties.

- Know what’s eligible: Not every distribution can be rolled over to an IRA—like required minimum distributions.

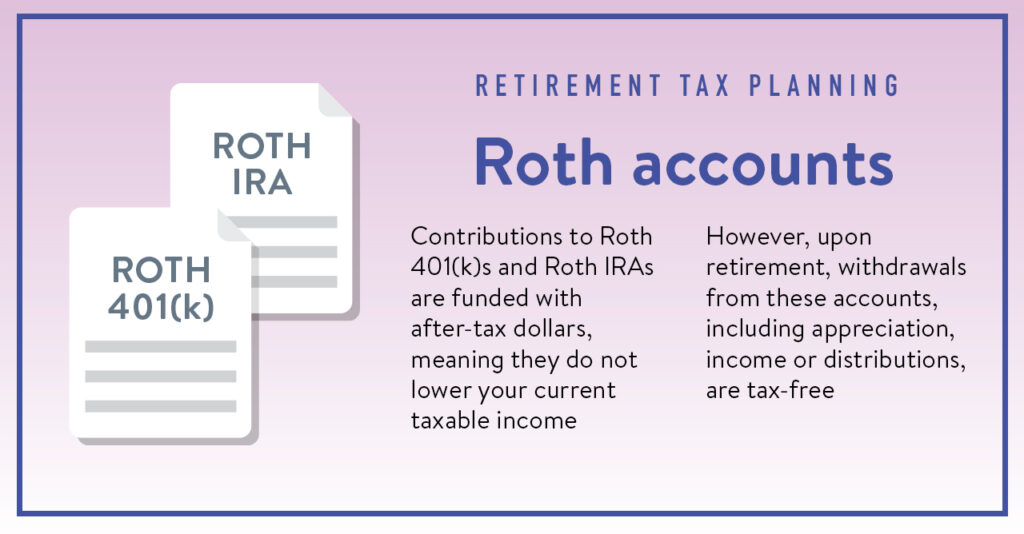

- Think about Roth timing: If you’re rolling a Roth 401(k) into a Roth IRA and it’s your first Roth IRA, you’ll need to wait five more years for tax-free withdrawals. This applies even if you’ve already met the five-year rule with your employer plan. Pro tip: If you think you’ll eventually roll over your Roth 401(k), it’s a good idea to open your Roth IRA now to start the five-year clock. This way, you’ll be closer to qualifying for tax-free withdrawals when you need them!

- Know what you’re giving up: Make sure you understand any benefits or guarantees you might lose by moving your money out of your employer plan. Weigh what matters most for your situation.

Rolling over your 401(k) can be a smart way to take more control of your retirement strategy—especially if it helps you see your full financial picture more clearly. But the right choice depends on your goals, comfort level and the specifics of your old and new plans.

Should I roll over my 401(k) into my new employer plan or an IRA?

Both can be good options. It depends on your priorities.

Rolling into a new 401(k) can be convenient. You’ll have fewer accounts to track, and your savings can keep growing under one employer’s plan.

Rolling into an IRA, on the other hand, could give you:

- A wider range of investment choices

- More control over your portfolio

- Potentially lower fees

“Not only does transferring those funds into an IRA help you continue saving for the future, but your money keeps growing tax-deferred,” said Dupaco’s Cassie DeVore.

Ultimately, it’s about what best aligns with your current financial needs and long-term goals. A trusted financial advisor can help you weigh your options.

Whichever you choose, the key is to keep contributing—especially if your new employer offers matching contributions. That’s essentially free money toward your retirement.

Request a free consultation with a financial advisor >

What happens if I cash out my old 401(k)?

It can be tempting to cash out your 401(k) after leaving a job. But doing so could have big long-term consequences.

If you withdraw this money early, you could face:

- A 10% early-withdrawal penalty if you don’t qualify for an exception. (Some exceptions to this penalty for IRAs include qualified higher education expenses and qualified first-time homebuyers.)

- 20% federal tax withholding.

That means you could lose a large chunk of your savings to taxes and penalties—and miss out on future investment growth. It’s important to consult your tax advisor to understand how an early withdrawal would affect you in both the short- and long-term.

If you have an immediate need for funding, it’s often better to explore other ways to access funds, like a personal loan or line of credit.

Request a free Money Makeover to review your options >

“Don’t forget that these funds are meant for retirement. You’re setting yourself back by cashing it in, even if it seems like a small amount,” DeVore said. “Every little bit you save now adds up later.”

How long do I have to roll over my old 401(k)?

In most cases, you have 60 days from the date you receive the retirement plan distribution to roll it over to another plan or IRA, according to the IRS. If you miss that window, you could face potential tax liabilities and penalties.

There are three ways to complete a rollover:

- Direct rollover: You can ask your retirement plan administrator to rollover your funds directly to another retirement plan or IRA—usually via a check made out to your new account. No taxes will be withheld from this transaction. Hint: You’ll want to reach out to your new financial institution to ensure a smooth rollover!

- Trustee-to-trustee transfer: If your distribution is from an IRA, you can ask the financial institution holding your IRA to transfer the money directly to another IRA or retirement plan. Like with direct rollovers, no taxes are withheld.

- 60-day rollover: If your distribution is paid directly to you, you have 60 days to deposit it into an IRA or retirement plan. Keep in mind that taxes will be withheld from the distribution. So, you’ll need to use other funds to roll over the full amount.

Rolling your 401(k) into a Dupaco IRA takes is simple. If your previous employer gave you forms to make your distribution election, Dupaco can help you complete and return them. But if you didn’t receive paperwork, Dupaco can call the company with you. Just have your 401(k) statement handy.

How can I find my old 401(k)?

If you’ve lost track of an old 401(k), your social security number can help you find it.

You can search for yours for free using the National Registry of Unclaimed Retirement Benefits. You’ll just need your Social Security number to get started. (The registry does not ask for any other identifying info.)

If there’s a match, you’ll get the details on where your 401(k) is waiting for you. Then, you can contact your former employer to claim your funds.

According to the national registry, when people retire or change jobs, they sometimes leave their retirement funds in their old employer’s plan. This money remains protected and is held by the employer until the former employee or their estate claims it.

Two exceptions allow an employer to transfer your account out of the plan:

- If your account balance is under $7,000.

- If the employer terminates the plan.

In these cases, the employer may transfer your funds to an Automatic Rollover IRA or a Missing Participant IRA, depending on the circumstances.

These free retirement saving resources are for you >

What’s next?

No matter where you are in your career, your old 401(k) can still play a big part in your future. The key is knowing where it is, understanding your choices and taking action.