Bright Savings Online-Only Savings Account

Give your savings a glow up—with 2.25% APY1

Open your online account in minutes, with no minimum balance requirements, no monthly service fees and no complicated earning tiers. Just smart tools and a brighter way to save (and earn).

Hint: Just turn on eStatements to earn the special rate!

Tools

Turbocharge your savings with smart tools made for you

Rates

Earn on your Bright Savings when you enroll in eStatements

| Account Type | Balance Tier | Dividend Rate | Annual Percentage Yield (APY)1 | Min. to Open | Min. to Earn |

|---|---|---|---|---|---|

| Bright Savings | $0.01 - $1,000,000 | 2.23% | 2.25% | $0 | $0.01 |

| Rates are effective as of 08/13/25 and are subject to change without notice. 1APY = Annual Percentage Yield. The rate is variable and may change after opening the account. APY is accurate as of the last dividend declaration date. To earn dividends, make sure you're signed up for eStatements. If you are not enrolled in eStatements by the end of the month, you will not receive any dividends. This account is available exclusively to consumer members. Business, fiduciary, minor, estate, and trust accounts are not eligible. This account must be opened online through Dupaco's Online Application and is limited to one account per Social Security Number (SSN). The Bright Savings Account will be limited to One Million dollars ($1,000,000.00), inclusive of all principal and dividend accruals. Fees could reduce earnings. Rates, terms, and conditions are subject to change at any time. |

|||||

Savings calculators

Crunch the numbers

Try our free calculators to see how much you might want to save—and how much your money could grow over time with the power of compound interest.

FAQs

Have questions? We have answers.

Our team of experts has answers to some of your most commonly asked questions. But if you’d rather talk to a human, you can give us a call at 800-373-7600. We can’t wait to talk!

It’s a savings account you open and manage entirely online—with no branch visits needed. Everything from deposits to transfers can be handled through Shine Online or Mobile Banking, whenever and wherever it works for you! It’s perfect if you do most of your banking on your phone or computer.

By keeping this account digital-only, it keeps things simple on our end. And we pass those savings on to you with better rates and fewer fees. With Bright Savings, there’s no minimum balance to open, no maintenance fees and no complicated requirements. It’s savings, made simple—just the way it should be.

Your money earns dividends (that’s our version of interest) every day. At the end of each month, your earnings are deposited into your Bright Savings account. And thanks to compounding, you earn dividends on those dividends—helping your savings grow even more over time.

Want to see how it works in action? Try our free compound interest calculator to estimate your savings over time.

You can only earn the special Bright Savings rate by enrolling in eStatements. Plus, this account comes with tools to help you save even smarter:

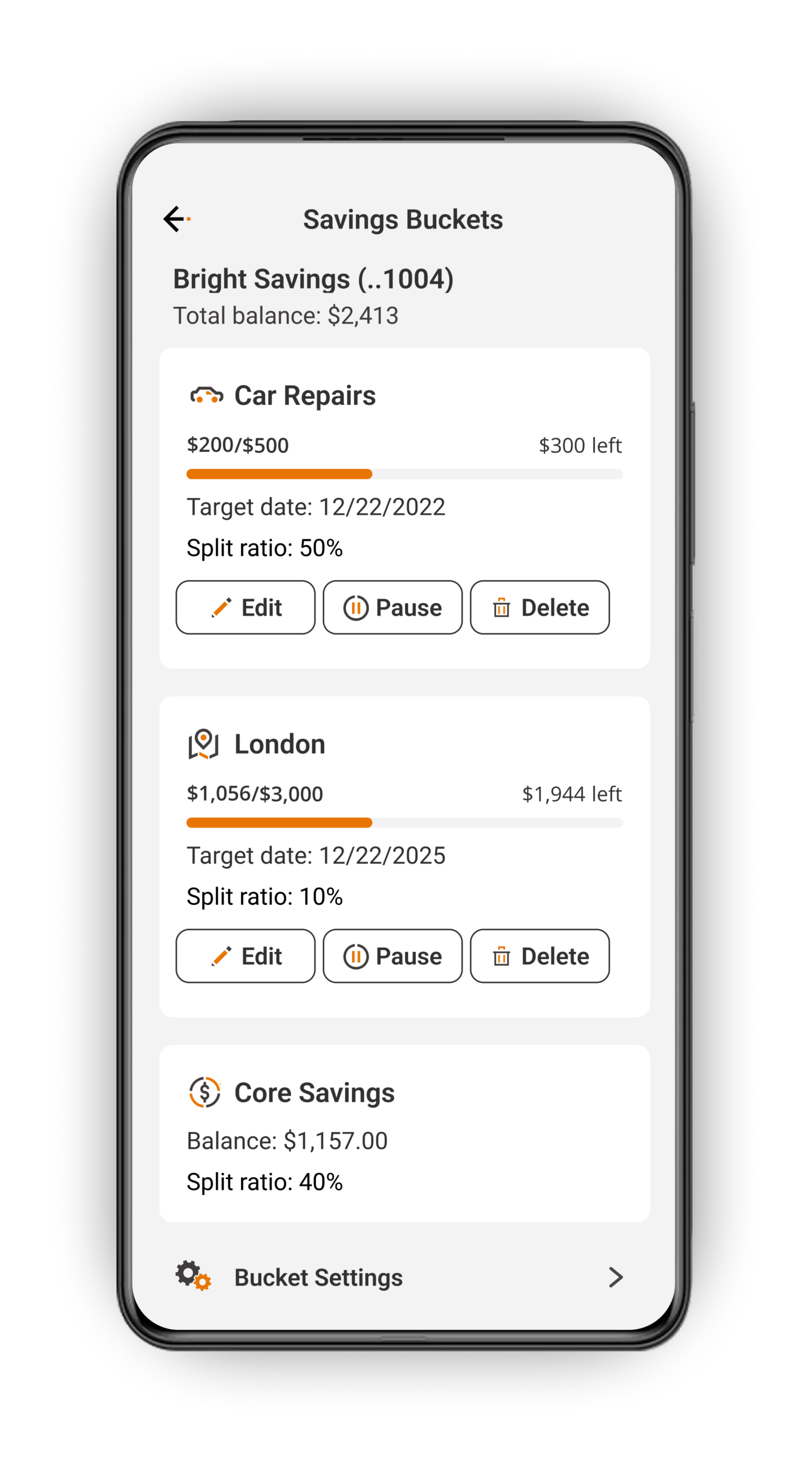

- Create virtual savings buckets for goals like vacations or car repairs—all within one account.

- Earn dividends on your total account balance, no matter how it’s split across buckets.

- Get personalized savings insights to spot new ways to save.

- Activate Smart Save to let the tool look for safe-to-save amounts and move money into your account automatically.

- Keep it simple: 1-6 buckets is usually plenty.

- Leave a cushion: Keep some money in Core Savings as a “stash” for life’s surprises.

- Split intentionally: Set split ratios for deposits based on your priorities (they just need to total 100%).

- Check in: Review and adjust your buckets regularly as life happens.

- Celebrate: Once you’ve reached your goal, you can move the money to Core Savings and transfer it out.

It’s quick and easy to do online—just click here to get started. The whole process takes just a few minutes. You don’t need to make a minimum deposit to open your account, but you will need to qualify for a Dupaco membership if you’re not already a member.

This online-only account is built for digital life—no branch visits, no paper statements. That keeps things simple on our end, so we can offer you a better rate. Just make sure you’re enrolled in eStatements to earn the special Bright Savings rate!

You have lots of options! You can:

- Transfer funds from your other Dupaco accounts using Shine Online or Mobile Banking.

- Schedule automatic transfers using Shine.

- Link an external bank account through Shine and transfer funds from that account.

- Set up direct deposit so part of every paycheck goes straight into your account. (You’ll need to work with your employer to get started.)

- Deposit checks into your account with mobile deposit in Shine.

- Turn on Smart Save to let the tool look for safe-to-save moments and move money into your account automatically.

Just keep in mind there’s a maximum account balance of $1 million.

You also have lots of options to access your money from this online-only savings account. You can:

- Transfer funds to one of your other Dupaco accounts using Shine Online or Mobile Banking.

- Transfer funds to someone else’s Dupaco account using Shine.

- Schedule automatic transfers from your Bright Savings account using Shine.

- Pay Dupaco loans from your Bright Savings account.

- Transfer funds to your Dupaco checking account and use your MoneyCard debit card to take out cash from a nearby ATM.

Don’t have a Dupaco checking account yet? Learn how to open one here.

All deposits are federally insured up to $250,000 by the National Credit Union Administration.

Nope! But having both can make things easier to manage your money. Plus, with a checking account, you’ll have easy access to your cash through a debit card, ATMs or check writing.

If you’re looking to earn a little extra, 1st Rate Checking pays dividends when you keep a higher balance. Want to keep it simple? Check out our no-fuss Free Checking.

No, because these are two different accounts. But you’re welcome to also open a Bright Savings account! Once it’s open, you can decide whether to keep both accounts or close one. If you need help closing one, give us a call at 800-373-7600.