What’s a certificate IRA and should it be part of your plan?

Updated Oct. 14, 2025, at 2:45 p.m. CT

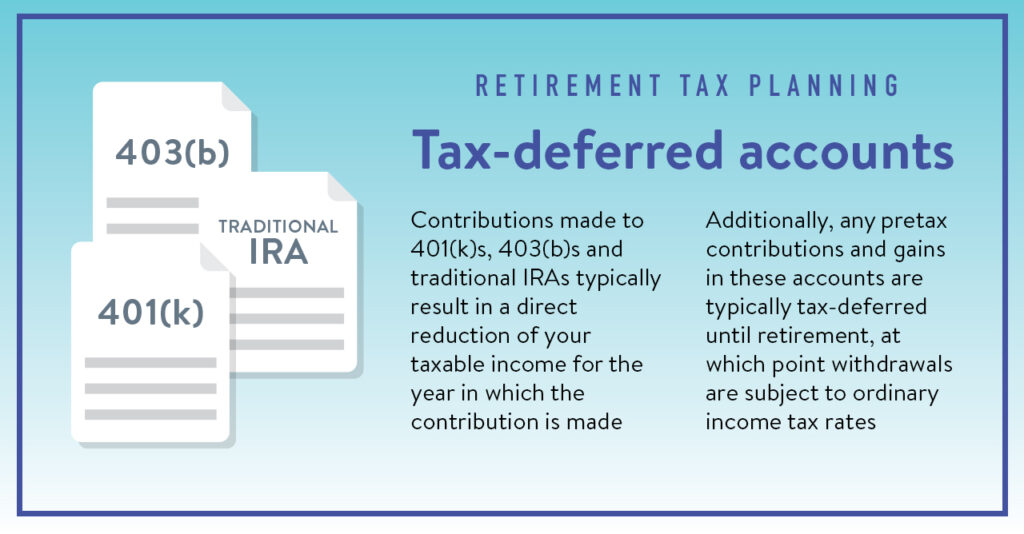

When you think about saving for retirement, your mind might go straight to 401(k)s or traditional Individual Retirement Accounts (IRAs) invested in the market. But what if you want something more predictable—where you know exactly what you’ll earn and when you’ll earn it?

That’s where a certificate IRA can come in. It’s a simple, low-risk way to grow your retirement savings without worrying about market ups and downs.

What is a certificate IRA?

A certificate IRA—sometimes called an IRA certificate or term-share certificate IRA—combines the steady growth of a certificate with the tax advantages of an IRA.

In other words, you’re investing your retirement funds in a certificate (the credit union’s version of the certificate of deposit, or CD) that earns a fixed rate over a set term. When the certificate matures, you can renew it, roll it into another investment or withdraw the funds (depending on your age and tax situation).

At Dupaco Credit Union, you can choose a certificate IRA term from 18 to 60 months, with a fixed rate that won’t change during that time. Dividends add into the account every six months, so you also earn interest on that additional amount, thanks to the power of compound interest.

Calculate your potential certificate growth >

Why some people prefer certificate IRAs

If you’re looking for stability, certificate IRAs could be a good fit. Here’s why people often choose them:

- Guaranteed returns: You’ll know your exact rate of return up front.

- Low risk: Your funds aren’t tied to the stock market, so you won’t lose principal if markets drop.

- Insured funds: At Dupaco, IRA deposits are insured separately by the NCUA up to $250,000.

- Steady income for retirees: Many retirees like the predictability of having certificates mature at regular intervals, providing dependable access to funds.

Certificate IRAs could be a great fit if you’re nearing retirement, already retired or simply want a reliable, low-risk option to complement your other investments.

Have a 401(k) from an old employer? Here’s what to consider >

Things to consider before opening a certificate IRA

Every investment has trade-offs, and certificate IRAs are no exception.

Before opening one, it’s important to understand how it works:

- Access to funds: With an IRA, withdrawals before age 59½ may be subject to IRS penalties and taxes.

- Early withdrawals: Taking money out of a certificate before it matures could also mean losing some earned interest. For example, Dupaco charges a 12-month loss of interest if funds are taken out before the certificate maturity date.

- Withdrawal options: Dupaco allows members age 59½ or older to withdraw 20% of your IRA certificate balances each year penalty-free.

- Renewal timing: At the end of your term, you have 10 days to change your IRA investments before it automatically renews at the current rate at Dupaco.

Explore Dupaco’s certificate IRAs >

How certificate IRAs fit with other retirement options

Think of certificate IRAs as a safe and steady companion to your other retirement accounts.

- If you already have a 401(k) or traditional IRA invested in stocks or mutual funds, a certificate IRA adds stability and predictability.

- Compared to an IRA savings account, a certificate IRA generally offers a higher fixed rate, but you’ll need to commit your money for the full term.

- Unlike market-based IRAs, which could rise or fall with the market, certificate IRAs offer peace of mind—you won’t lose your initial deposit as long as you hold it to maturity.

Generally, the market will yield a larger rate of return over time, so it’s important to speak with a financial advisor to ensure you’re investing your retirement funds the best way for you.

In short: This sometimes-overlooked retirement investment strategy won’t deliver the highest returns, but it could help you balance your portfolio.

The bottom line

Certificate IRAs are a simple, dependable way to grow your retirement savings. And at some point, they usually come into play for most people saving for retirement.

They don’t require constant monitoring, and you’ll always know exactly what you’re earning.

They may not make sense for every saver. But for those who want low risk, guaranteed returns and steady growth, they can play an important role in a balanced retirement plan.