Let's get started. Which describes you best?

Not sure which checking account is right for you? Compare your options here.

Your membership and active checking account comes with lots of free perks including:

Hint: Don’t forget to use giveback code CHECK300 during account setup to get $300* deposited into your new checking account!

Whatever your checking needs are, we've got you covered.

We offer two great checking accounts to choose from. And whichever you choose, we’ll deposit $300* back into your new account. Just enter the giveback code CHECK300 during account setup.

No hassles or unexpected charges, and no hoops to jump through. Dupaco’s Free Checking is as straightforward as it gets.

- No minimum to open

- No monthly service charges

- No minimum monthly balance requirement

- Unlimited check writing and deposits

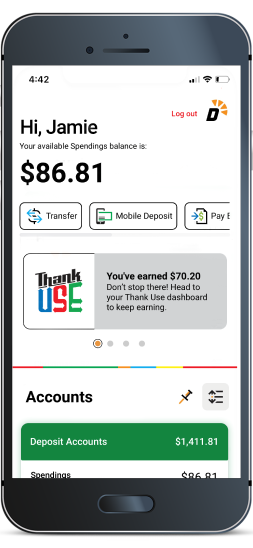

- Free Online & Mobile Banking services

- Free Dupaco MoneyCard debit MasterCard with EMV chip technology

You work hard for your money. Isn’t it about time your money starts working as hard for you? With a Dupaco 1st Rate Checking account, it will.

- No minimum to open

- Tiered interest on accounts with a minimum monthly balance of $5,000

- No monthly service fee with an average monthly balance of $5,000 (otherwise a $10 fee per month)

- After 125 accumulative transactions of checks written or deposits made per month, $0.20 will be charged per item for each additional check written or deposit made

- Free Online & Mobile Banking services

- Free Dupaco MoneyCard debit MasterCard (with EMV chip)

Current Rates

| Balance | Dividend Rate | Annual Percentage Yield (APY)1 | Min. to Open | Min. to Earn |

|---|---|---|---|---|

| $100,000+ | 0.15% | 0.15% | None | $100,000 |

| $25,000 - $99,999.99 | 0.15% | 0.15% | None | $25,000 |

| $5,000 - $24,999.99 | 0.10% | 0.10% | None | $5,000 |

| Less than $5,000 | N/A | N/A | None | N/A |

| Rates are effective as of 04/01/2023 and are subject to change without notice. 1Checking Rates: Dividends and annual percentage yields (APY) accurate as of the last dividend declaration date. The dividend rate and annual percentage yield may change after account opening. Fees could reduce earnings on the account. |

||||

*CASH PAYOUT: Member must mention offer in branch, over phone OR enter promo code online to receive promotion. The $300 cash payout is deposited to checking 3-5 business days after active checking definition is met; provided a share draft checking account balance of $0 or more is required at the time of cash payout. 1099 INT issued for cash payouts and members are responsible for applicable taxes.

Account opening subject to qualification and approval. Member will be ineligible for this offer if opening a consumer share draft checking account within 180 days after closing a prior consumer share draft checking account for which they were an account owner (joint or otherwise). Existing checking accounts are excluded from this offer. Any member or account owner (joint or otherwise), with an existing checking account, is excluded from this offer. Anyone, member or applicant, with a charged off deposit account at Dupaco Community Credit Union will be ineligible for this promo. Members who are delinquent, on any loan, for 60 consecutive days or more at the time of account opening or at the time of cash payout are ineligible for this promo.

Cannot be combined with other checking offers. This offer is limited to a maximum of one Dupaco consumer share draft checking account per member. Business share draft checking accounts are not eligible for this offer.

Dupaco membership required. You can join if you live or work within our charter area or have a family member who is a Dupaco member, and you make an initial $25 deposit into your share savings account. Other offer restrictions may apply. Dupaco reserves the right to alter or terminate this offer at any time prior to its acceptance.

ACTIVE CHECKING DEFINITION: Within 90 days of account opening, either: a) Set up direct deposit to your checking account, and have a total of five or more check, debit card or automated clearing house (ACH) debit transactions on that checking account, OR b) If you cannot directly deposit to your checking account, then have ten check transactions, or eight debit card transactions, or five ACH debit transactions or three bill pay transactions on that checking account.

CURRENT RATES: For the most up to date checking account rates, click here. Rates are variable and may change after account is opened. Fees could reduce account earnings.