You still have time to save in these accounts

Updated Feb. 14, 2024, at 9:10 a.m. CT

Procrastinators, rejoice!

If you meant to set aside more money for retirement or health expenses last year, you still have time.

Individual Retirement Accounts

You’ve heard it before, but it’s worth repeating: The sooner you start saving for retirement, the more money you’ll have later when you need it.

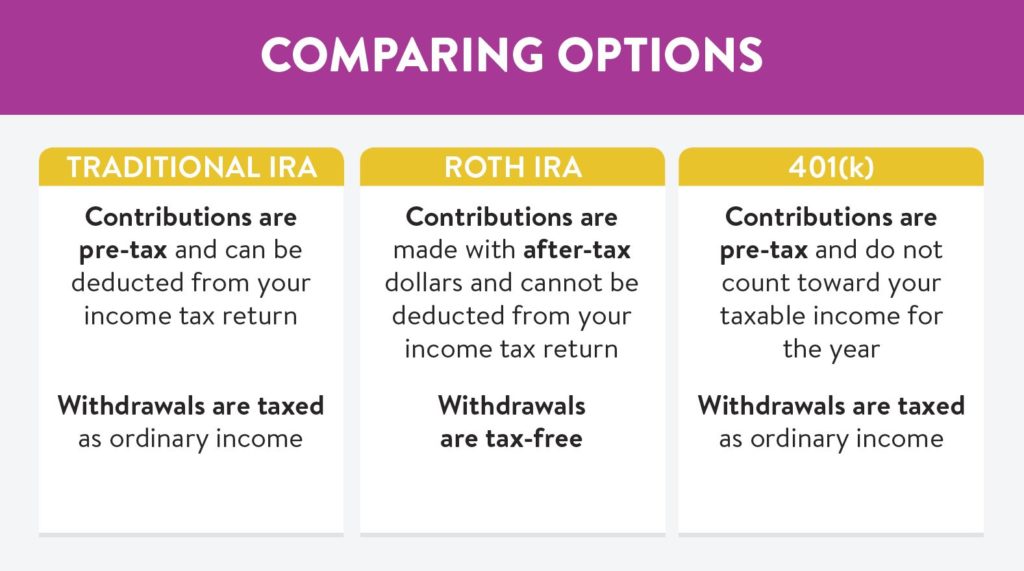

IRAs offer a tax-advantaged way to invest—and save—for retirement.

Did you hear? This law could impact how you save for retirement >

If you’d still like to contribute to an IRA for 2023, here’s what you need to know:

- Eligible individuals can make contributions to a Traditional or Roth IRA for 2023 until April 15, 2024.

- IRA contributions for the 2023 tax year are limited to $6,500 ($7,500 if you’re 50 or older) or your earned income for the year—whichever is less.

- Individuals of any age can now make Traditional IRA contributions if you (or your spouse, if filing a joint return) earned income during that tax year, thanks to the Setting Every Community Up for Retirement Enhancement Act of 2019 (SECURE Act).

- You could receive a deduction for Traditional contributions or a saver’s tax credit for Traditional or Roth contributions.

Learn more about IRA guidelines >

Health Savings Accounts

Health Savings Accounts

If you have a high-deductible health plan, an HSA can help you set money aside for current and future medical expenses.

To be eligible for an HSA, you:

- Must be covered under a high-deductible health plan.

- Can’t be covered by another health plan (with limited exceptions).

- Must not be enrolled in Medicare.

- Can’t be claimed as a dependent on someone else’s tax return.

If you want to contribute to an HSA for 2023, here’s what you need to know:

- Eligible individuals can make contributions to an HSA for 2023 until April 15, 2024.

- For your HSA, you can contribute up to $3,850 for self-only coverage ($4,850 if you’re 55 or older) or $7,750 for family coverage ($8,750 if you’re 55 or older).

- HSA-eligible individuals can make tax-deductible contributions, earn tax-free dividends and withdraw money tax free for qualified medical expenses.

- You don’t have to use all of your HSA funds each year. Your balance carries over—and remains with you regardless of changes in coverage or employment.

Learn more about HSA guidelines >

* Contact your tax advisor to verify eligibility and contribution limits.