How much should you save for retirement?

In a perfect world, you would start saving for retirement with your very first paycheck and keep at it until the day you left your job some 40 years later.

But not everyone works consistently. And, unfortunately, not everyone is able to save consistently.

Sometimes life steps in with job losses and unexpected illnesses that sidetrack our goals. The good news is that it’s never too late to get started on or build up your retirement savings.

If you’re in your 20s, 30s or 40s (or even 50s) and haven’t started saving for your retirement, now is the time.

The sooner you begin putting money away, the larger your bucket will grow.

Launchpad helps you save for retirement a little at at time >

How much should you be saving?

So, exactly how much should you be saving for retirement?

Like so many things, it really depends.

A good rule of thumb is to save 15% of your income–20% if you can swing it–which includes any matching retirement funds from your employer.

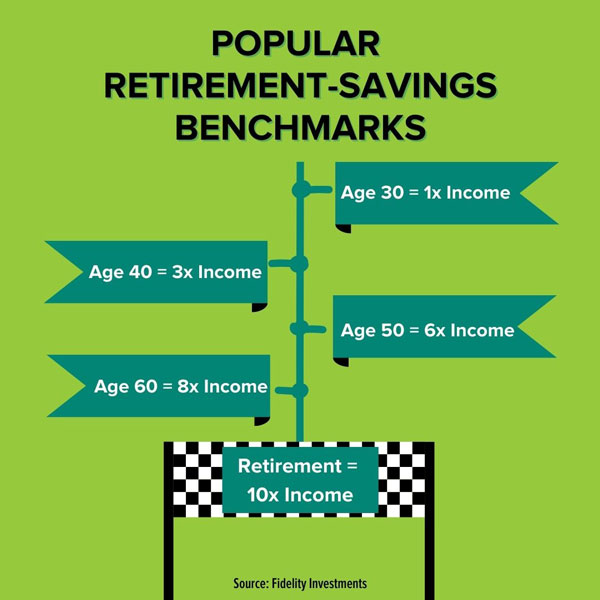

There are also a series of benchmarks aimed at helping people figure out whether they are on track for retirement. (But a financial advisor can help you determine how much you should be saving based on your unique financial situation and goals. You can request a free review here.)

Fidelity Investments recommends that by age 30, you should have 1x your income socked away for retirement. By 40, 3x. By 50, 6x. By 60, 8x. And by retirement 10x.

Do this and you’ll typically be able to replace about 80% of your pre-retirement income for a period of 30 years. Of course, not everyone will hit those marks on schedule—or ever.

The EBRI Retirement Security Projection Model shows that 40% of people aged 35 to 64 risk not having enough to meet their retirement expenses.

Similarly, the National Retirement Risk Index, produced by the Center for Retirement Research at Boston College, shows 50% of the population won’t have enough to maintain their current lifestyle in retirement.

And yet, “retirement can be a lot cheaper than your working regular life,” says Annamaria Lusardi, professor of economics and accountancy at The George Washington University School of Business.

“You may no longer have to provide for your children, you might not need two cars for the household anymore if both of you aren’t working and you can even cut costs by moving into a smaller home.”

The point? One size does not fit all. Here are some guidelines for figuring out whether you are saving enough.

Request a free review of your retirement plan >

Remember, it’s your retirement

What do you want your retirement to look like?

If you haven’t asked that question, with your spouse or partner if you have one, it’s time.

Only once you envision it can you begin to price it out. Because that’s when you’ll answer the questions about things like where you’ll live (in your big family home or a smaller one that will allow you to sock some of that prior home equity into savings), whether you’ll work (as many retirees do), if you’ll move (and lower your taxes as a result).

The question of when you’ll retire is similarly important.

The longer you continue to work, the more time your retirement savings have to grow and the fewer number of years you’ll have to rely on that stash to fund your lifestyle.

Once you’ve got the answer to these questions, sit down with pen and paper (or a spreadsheet if you’re so inclined) and start adding up the amount you’ll need to live. If you’re struggling, a sit-down with a financial advisor can help.

Explore our free retirement resources >

Focus on income replacement

Once you’ve got a sense of the numbers, you can begin working on how to get there.

Start with Social Security. How much of your estimated monthly expenses will that cover? (If you don’t know what you’re expecting from Social Security you can get your estimate at ssa.gov.)

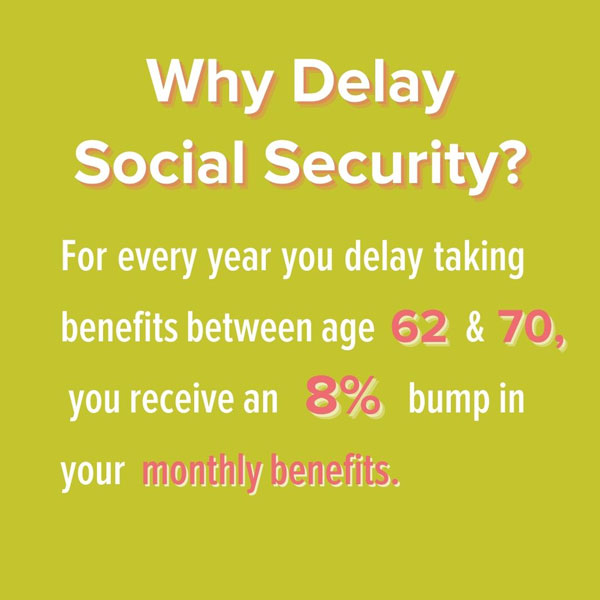

Many people start taking their benefits at age 62, but waiting means more money every month. For every year you delay taking benefits from 62 until 70, you’ll receive an increase of about 8%.

That’s a huge help.

Subtract that from the amount you estimate you’ll need to live each month. Then consider whether you’ll be receiving any pension income.

Although most people in the U.S. no longer have pensions, many military families and teachers do. If you have a pension, subtract your pension income from your monthly needs as well. What remains is the amount you’ll want to cover with retirement savings.

“Based on the 4% safe withdrawal rule, a million-dollar portfolio creates $40,000 of annual income,” says David Littell, professor of retirement income at The American College of Financial Services.

You may need more. But you may also need less.

Savings calculators

There are dozens of tools and guides to help you figure out if you’ll have enough money to cover your basics.

One free (and excellent) online retirement planning tool is the AARP retirement calculator.

It takes you through a step-by-step questionnaire that accounts for Social Security and other potential income sources (like proceeds from the sale of real estate and inheritances).

Use it to get a detailed chart of your income sources over time and identify potential gaps. The calculator allows you to make a variety of adjustments to see how you can help improve your odds of not outliving your money.

If DIY planning makes you nervous, a financial planner can help you create a customized roadmap and implement suitable strategies. (Here are five questions to ask any financial planner before you hire them.)

Try our free retirement calculators >

Make your money work for you

Finally, as you mull over these questions of how much you’ll need in retirement, you also want to be sure your assets are working to get you there. In other words, that they’re invested in a way that lines up with your risk tolerance and time horizon.

Your investment portfolio should be diversified, made up of a mix of stocks and bonds. Exactly how much of each depends on how long you have until retirement and how much risk you can withstand.

If you have many years to go, you can take more risk, which means your portfolio may be more heavily weighted toward stocks and other high-growth asset classes. (A target-date retirement fund is a one-and-done solution that can help keep your mix in check.)

But you should also consider getting some help.

A financial planner can help you create a road map to your future that takes your short- and long-term goals into consideration. They can also help you keep emotions in check when the markets tank, and get you back on course when you need to change your finances to keep up with your changing life.

Social Security Webinar: Know your options. Maximize your benefits.

Are you nearing retirement? Have questions about Social Security benefits?

Drop us your info below to get access to our free on-demand webinar to learn how you can make the most of retirement and maximize your Social Security benefits.